Regulatory compliance software built on 20 years of continuous innovation

Industry-leading financial services compliance software

Trade Surveillance

Simplify, streamline and strengthen your trade surveillance through the most flexible and feature-rich solution available on the market today.

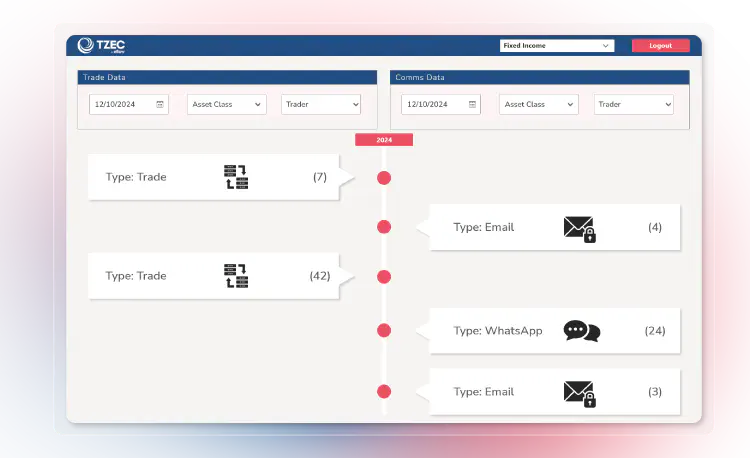

eComms Surveillance

Generate a comprehensive view of communication channels, identify potentially suspicious behaviour, and make informed, data-led decisions.

Best Execution and TCA

Demonstrate compliance with Best Execution legislation and uncover commercial insights with transaction cost analysis in a single digital solution.

Transaction Reporting

Manage all of your transaction reporting obligations from a single platform that automates data reconciliation, error handling and report submission.

The PATH digital ecosystem

PATH is the digital ecosystem on which all of eflow’s regulatory compliance software is built, seamlessly integrating trade surveillance, eComms surveillance, best execution and transaction reporting.

It’s the product of more than 20 years of in-house research and development, combined with ongoing enhancements that have been developed in conjunction with leading financial institutions from around the world. Ultimately, its job is to make your job easier, quicker and more efficient.

Trusted by 140+ financial institutions worldwide

Here’s a small selection of what our clients have to say about working with eflow and our regulatory compliance software.

We were particularly impressed by eflow’s market behaviour analysis tools which examine market movements by looking at micro factors and global events combined. This more holistic approach can be a better way to examine market activity to differentiate between standard market changes and fraudulent behaviour.

We spoke to several vendors as part of the selection process but eflow immediately stood out as a good fit for our business. Not only was TZTR an impressive solution to our challenges, but we quickly established that their technical knowledge was second to none.

Effective risk management at Finalto requires the ability to review large sets of information and generate meaningful, risk-relevant analysis. Our partnership with eflow reflects that commitment, bringing in a solution that strengthens our oversight, improves anomaly detection, and supports our strategy to embed scalable, intelligent technology across compliance and risk.

The eflow team has been very supportive throughout the process, from onboarding through to ongoing customer support. They took the time to get to know our business and the specific challenges that we faced, and were able to present solutions that directly responded to those pain points. This collaborative approach quickly established the credibility of their team and helped to build our trust in them.

We have been consistently impressed with eflow’s constant dedication to ensuring that our compliance needs are met. We would recommend them to any firm looking for a market abuse or best execution solution.

eflow’s commitment to product development as regulation changes stands out amongst its competitors. With eflow we are confident that we have a partner that will evolve as our requirements also evolve.

RBC Brewin Dolphin has used TZTS for trade surveillance for six years. At RBC Brewin Dolphin we consider a vendor relationship to be more than just the vendor providing a product; we look for vendors who are committed to product and customer service improvement. eflow fit that requirement perfectly.

As our business grows, it’s imperative that our trade surveillance technology can scale with us. eflow’s TZTS system will help us to automate previously manual processes, strengthen our end-to-end regulatory controls, and operate more efficiently.

We were particularly impressed by eflow’s market behaviour analysis tools which examine market movements by looking at micro factors and global events combined. This more holistic approach can be a better way to examine market activity to differentiate between standard market changes and fraudulent behaviour.

We spoke to several vendors as part of the selection process but eflow immediately stood out as a good fit for our business. Not only was TZTR an impressive solution to our challenges, but we quickly established that their technical knowledge was second to none.

Effective risk management at Finalto requires the ability to review large sets of information and generate meaningful, risk-relevant analysis. Our partnership with eflow reflects that commitment, bringing in a solution that strengthens our oversight, improves anomaly detection, and supports our strategy to embed scalable, intelligent technology across compliance and risk.

The eflow team has been very supportive throughout the process, from onboarding through to ongoing customer support. They took the time to get to know our business and the specific challenges that we faced, and were able to present solutions that directly responded to those pain points. This collaborative approach quickly established the credibility of their team and helped to build our trust in them.

The latest regulatory insights from eflow

Read expert perspectives on the latest regulatory developments, market abuse trends, financial services compliance software, and much more.