FCA Market Watch 81: Transaction reporting data quality improves, but work still to be done

The FCA recently published Market Watch 81, its regular update on key regulatory matters and how firms can improve the quality of their reporting. This latest edition focuses on the Regulator’s supervision of the UK MiFID transaction reporting regime and covers their assessment of findings from skilled person reviews issued under section 166 FSMA to address transaction reporting failings.

This work will be of particular relevance to firms that are subject to UK MiFID transaction reporting requirements, but will also be relevant for firms that have trade reporting obligations under UK EMIR and SFTR.

Background information

The FCA’s Market Watch 74 highlighted that the quality of data being provided by firms as part of their transaction reporting has improved since 2018. However, while this positive trend is recognised by the Regulator, it also identified that firms still have room for improvement.

Incomplete or inaccurate transaction reports continue to be submitted by firms, with the FCA expressing particular concern around persistent data quality issues that reoccur despite being flagged to the firms in question. In some cases, these data quality issues continue to happen even after a firm has confirmed that action has been taken to remediate the reports in question.

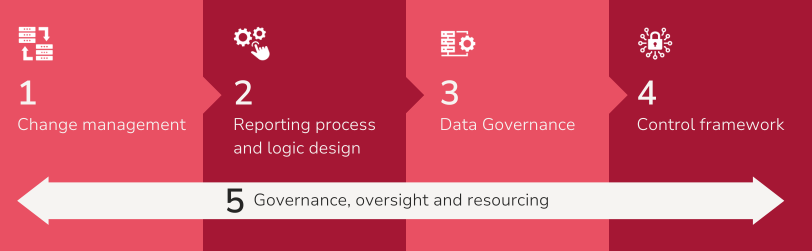

The FCA has examined such instances and has identified common reporting weaknesses that firms need to be aware of and address to avoid the risk of non-compliant reporting:

- change management

- reporting process and logic design

- data governance

- control framework

- governance, oversight and resourcing

These links in the chain of transaction reporting can be considered independently, although the FCA has stated that the data quality issues they are seeing are often as a result of a weakness in one area that then spreads to others (see figure 1 below). The Regulator’s commentary on each of these sections is expanded on below.

Change management

Change management is often a challenge for any type of organisation, but this is particularly the case for financial institutions which are often subject to intricate and sophisticated regulatory processes. For example, even a relatively small change to internal operations can result in variations to testing protocols, data mapping and other key factors that can fundamentally impact the quality of reporting.

The FCA highlighted several key observations:

- Poor change management is often a key reason for data quality issues. For example, some firms did not undertake business analysis to map out MiFID II requirements and were left with significant reporting gaps.

- Insufficient documentation related to the decision making behind changes can create knowledge gaps. This can increase the complexity for firms in cases where they are required to remediate data quality issues, including back reporting.

- The outsourcing of change processes to third parties can often cause data quality issues, particularly in instances where there is inadequate oversight over the scope of deliverables or a lack of transaction reporting expertise within the firm itself.

- Changes in personnel or staff turnover can result in data quality issues due to a lack of clear procedural policies that can be followed in the absence of key individuals.

Reporting progress and logic design

For a transaction reporting system to operate effectively, controls must be supported by clear reporting processes and logic design documents. These documents should explain the rationale that underpins reporting processes and detail how they have been designed to meet regulatory and operational requirements.

The FCA highlighted several key observations:

- Some firms have interpreted regulatory requirements and designed their reporting logic without considering the firm’s business context. This has resulted in misreporting, such as populating RTS 22 field 36 (venue) with a trading venue market identifier code when reporting as a DEA user.

- A poorly implemented transaction reporting process may result in resources being allocated to the project in an ad-hoc way, with poorly defined deliverables. This can sometimes result in manual processes that delay the submission of reports, create a backlog in exception management, and generate further complexity for firms when transaction reports need to be cancelled and amended.

Data governance

Accurate transaction reporting is clearly heavily reliant on multiple internal and external data sources. The FCA highlights that even the smallest disconnect in the data management process can result in misreporting, while effective data governance can streamline data flows and enrich transaction reports at the appropriate stage of the reporting process.

The FCA highlighted several key observations:

- Many firms gather data from various sources as part of their transaction reporting process. The fragmented nature of this approach increases the likelihood of errors occurring and process inefficiencies.

- Poorly documented data lineage can damage the integrity of the data that underpins transaction reports. If this data is inaccurate, it can often go undetected, creating regulatory ‘blind spots’ and misreported transactions.

- Poor record keeping severely hampers a firm’s ability to audit its records and correct historic transactions retrospectively. As a reminder, under UK MiFIR investment firms must keep relevant data relating to orders and transactions that they have carried out for five years.

- Inadequate security or change management processes for personal data can result in unauthorised modifications being made. This obviously presents a risk to the accuracy of transaction reports and could go unnoticed for an extended period of time.

Control framework

It goes without saying that firms must take all possible measures to ensure that their transaction reports are complete and accurate. This often takes the form of a control framework that is informed by a firm’s end-to-end transaction reporting process. Understanding this process and its vulnerabilities can direct control placement.

The FCA highlighted several key observations:

- Poorly designed reconciliation processes are likely to prevent firms being able to identify underlying data quality issues.

- Some firms undertake reconciliations on specific fields only, or on an irregular basis. This approach may not be sufficiently robust to identify all errors and omissions in their transaction reports or meet the RTS 22 requirements.

- Some firms have failed to review or update their controls as reporting processes have evolved, which means that they are unlikely to align with Article 21(5) of MiFID Org Regs.

Governance, oversight and resourcing

Robust governance is crucial to maintaining the integrity of a transaction reporting process. Therefore, effective management oversight is essential in identifying any process or data-related issues, taking appropriate action, and ensuring that suitable resources are deployed to implement changes as required.

The FCA highlighted several key observations:

- Excluding transaction reporting from a firm’s wider risk management framework can result in limited consideration of transaction reporting as an operational, compliance and reputational risk.

- Appropriate MI is key in enabling senior management to fully understand, and act on, regulatory and operational risks of a firm’s transaction reporting. Without this, decision making can be impeded and cause risk management interventions to be delayed.

- Organisational structures and reporting lines should be clear and appropriate to support the effective oversight of transaction reporting risks and reporting issues.

- Unclear terms of reference across various governance bodies can lead to a lack of awareness of specific procedures and prevent individuals from discharging their duties appropriately.

- Firms should continuously review and improve their transaction reporting processes based on comprehensive oversight conducted by suitably experienced and qualified professionals. Firms should also have a formal Compliance Risk Assessment (CRA) process in place.

- Responsibility for the management of the transaction reporting process should be clearly defined, with individuals being held accountable for process assessment, policies and procedures.

- Transaction reporting functions should be suitably resourced to ensure operational effectiveness. Many firms do not have sufficient tooling or staff deployed to this process which can delay report submissions, exception management, implementation of regulatory changes, and remedial action being taken.

How eflow’s transaction reporting technology helps firms to overcome these challenges

eflow’s TZTR platform has been engineered to offer firms a robust, holistic and dynamic solution to the transaction reporting challenges identified in Market Watch 81.

Change management

Every client that is onboarded to TZTR benefits from a tailored system implementation that is managed by our in-house team of experts. This means that your system is configured to your exact specification and fully documented so that you have a comprehensive record of how your system operates.

Once operational, TZTR is regularly upgraded as new functionality is released or regulatory requirements go live, offering you complete peace of mind that your system represents one true view of your transaction reporting.

Reporting process and logic design

The TZTR platform is configured to align with your firm’s regulatory and operational requirements. These are fully documented as part of your system implementation so that you have a clear understanding of how the system operates and reports are generated, offering a ‘regulator ready’ view of your transaction reporting processes from start to finish.

Data governance

TZTR automatically ingests your trade data and cross-references all records against the FIRDS Register to ensure eligibility. It also includes automated data enrichment for all alerts and asset types from the eflow Market Data Store, which curates data from more than 250 sources, enriching transaction reports throughout the process. Highly configurable access controls allow you to manage data permissions on a user-by-user basis, while comprehensive internal audit trails enable you to track all activity across your team.

Control framework

TZTR mitigates against the risk of incomplete and inaccurate reporting by flagging errors or missing information for further investigation. Embedded error handling and field-by-field editing within the platform automatically create a detailed audit trail of any changes, providing clear, verifiable evidence of compliance.

Governance, oversight and resourcing

TZTR enhances governance processes through clearly defined user roles that enable errors and amendments to be escalated, approved and recorded directly within the platform. Process and workflow automation also significantly reduces the operational burden on compliance teams, allowing them to focus on more complex tasks rather than time consuming data administration. Finally, TZTR generates highly detailed reports that provide clear, highly visual management insights that also satisfy the most granular of requests from regulators.

If you’d like to find out more about how TZTR could work for your firm’s transaction reporting, get in touch to book a consultation with one of our experts.