FCA requests details of communication policy breaches

The FCA has requested that UK banks report details of any employees breaching their communication policies in a move signalling a further crack-down on controls around eComms monitoring and surveillance.

This follows reporting from FN that the FCA would begin to survey firms with regards to how they use and monitor messages sent using so-called off-channel communication platforms such as WhatsApp, Signal and Telegram.

With growing concerns around the increased risk of market abuse and insider trading caused by poor controls around off-channel communications, this recent flurry of activity may indicate that the FCA is looking to more closely align themselves with US regulatory standards.

The stance of US regulators

Since 2021, US regulators - namely the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) - have made the unmonitored use of off-channel communications an area of focus for regulatory enforcement. Tier one institutions such as Goldman Sachs, JPMorgan Chase and Bank of America have all faced such fines, with approximately $2.8bn in penalties being levied since 2021 for improper controls around communications surveillance.

While the FCA’s fines have been relatively small in comparison, this latest initiative may indicate a change in approach is forthcoming.

If results from this latest survey indicate a significant risk of market abuse and insider trading being created by failures in communications monitoring - a fact that seems likely if we consider the North American market - then further investigations and strengthened regulatory controls seem highly likely.

Why is communications monitoring important?

Ultimately, this focus on communications record keeping and monitoring is about transparency and risk management. If firms don’t have robust controls in place around off-channel communications, then traders will be able to send private, encrypted messages freely. As a result, firms will be unable to demonstrate their compliance with market abuse regulations to regulators and the risk of non-compliant activity will be increased.

Unmonitored communication channels create surveillance gaps, which in turn create points of risk; if employees are allowed to communicate about trades on unmonitored platforms, gaps in the regulatory audit trail are created. This leads to a heightened risk of market abuse and insider trading and a lack of demonstrable compliance with regulatory standards.

To that end, it is vital that firms track and analyse all relevant communications between employees. Not only does this limit the risk of abusive or insider trading, but it also allows firms to protect their own reputation and the integrity of the market.

How can firms protect themselves?

As the regulatory focus on robust record keeping and monitoring of communications grows, firms will need to prove to regulators that they have suitable controls in place if they want to avoid a regulatory backlash.

While simply keeping records of communications may have previously sufficed, firms today are increasingly expected to be able to actively monitor those communications for evidence of potentially abusive trading.

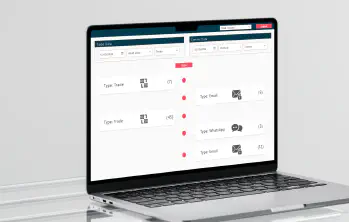

Recent technological advancements have allowed firms to implement solutions that can not only store records of communications, but actively surveil them for evidence of behaviours indicative of market abuse or insider trading. By harnessing machine learning technologies such as natural language processing and sentiment analysis, these tools can flag suspicious messages before linking them to relevant trades. This integrated approach allows firms to indicate that they are generating a holistic overview of risk which incorporates both communications and the trade data itself.

eflow’s eComms surveillance solution TZEC has been designed specifically to provide this service to firms. It can capture data from any platform - on- or off-channel communications, email or voice calls - analyse those communications for potentially suspicious language, then link those messages to relevant trades to provide a holistic overview of the entire trade lifecycle.

If you’d like to learn more about how TZEC could help your firm, book a consultation here.