Global regulatory enforcement action update - Q3 2024

Q3 2024 enforcement update: The cost of unmonitored communications

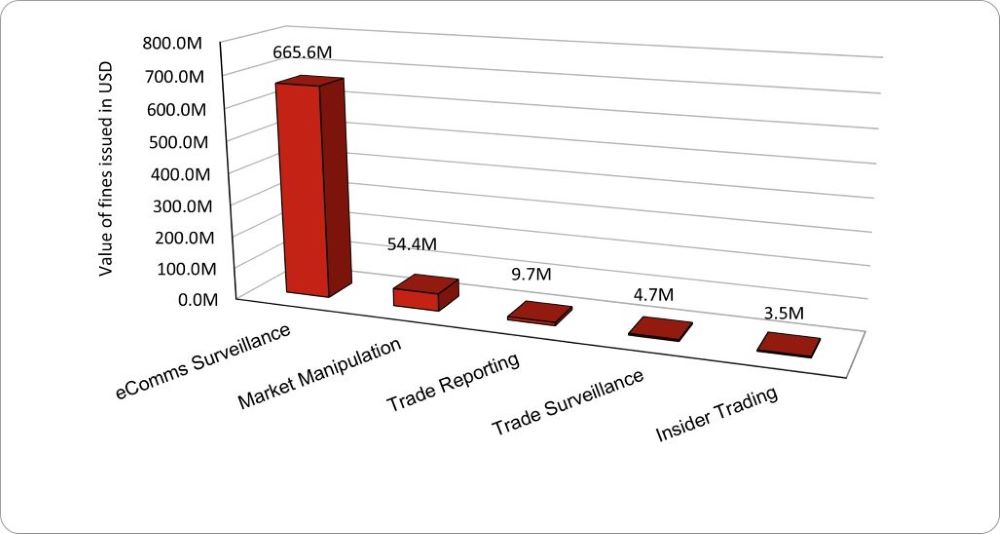

In the third quarter of 2024, enforcement actions related to market conduct reached a combined value of almost $800 million across four jurisdictions, with regulators coming down hard on widespread deficiencies in off-channel communications monitoring.

The total value of fines issued in these three months alone were almost equal to those levied in the first six months of the year, while the number of fines has almost doubled.

In this blog, we present an overview of what’s driven such a significant uplift in regulatory activity. Spoiler alert: traders are still using WhatsApp.

Q3 enforcement action in numbers

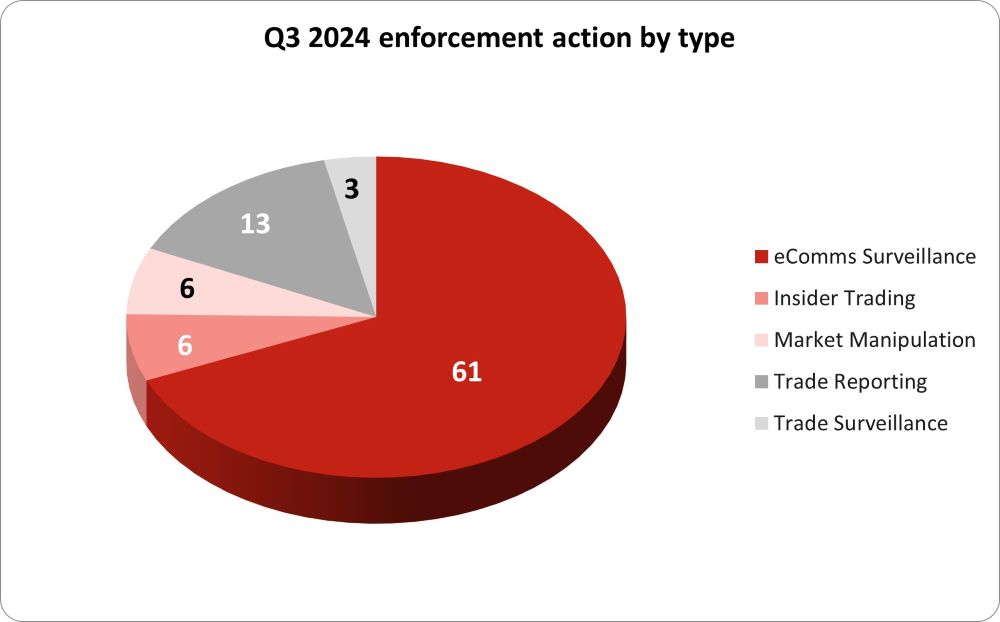

In the last three months, 89 market conduct enforcements were issued by global regulators, the majority of which were for eComms surveillance failures…

The fines associated with this action totaled nearly $740 million…

Electronic communications remain in Regulators’ focus

Q3 saw yet another surge in regulatory scrutiny around recordkeeping practices, with US regulators imposing 61 fines related to off-channel communications on platforms like WhatsApp, Signal, and Telegram. The SEC and CFTC continue to lead the charge, imposing penalties against institutions of varying sizes. Notably, Toronto Dominion Bank received a $75 million fine, while others like Canadian Imperial Bank of Commerce and prominent rating agencies - Moody’s Investors Service, Inc. and S&P Global Ratings - also faced substantial repercussions.

Penalties typically correlated with the severity and duration of deficiencies, and in many cases, firms’ inability to capture and store encrypted communications not only hindered regulatory investigations but also heightened internal risks, eroding trust in their compliance frameworks.

Despite the sharp consequences, the benefits of proactive cooperation are clear. According to Gurbir S. Grewal, Director of the SEC’s Division of Enforcement, “there are several [firms] that differentiated themselves by self-reporting prior to the staff’s investigation, demonstrating once again the real benefits of proactive cooperation.” Firms that identified gaps and engaged with regulators early on saw a tangible reduction in penalties. In contrast, those slower to enact remedial protocols often faced harsher sanctions and the requirement to retain compliance consultants to manage future oversight

The ripple effects of these enforcement actions are now being felt beyond the US, as the UK’s Financial Conduct Authority (FCA) has initiated probes into how banks monitor encrypted communications by sending surveys that request disclosure of policy breaches. These actions are the FCA’s most obvious signal yet that a similar enforcement strategy is likely to follow if results from these inquiries don’t meet regulatory expectations.

Market manipulation in commodities markets

The US CFTC has also been intensifying efforts to protect market integrity throughout the energy sector, where the effects of malpractice can cascade across global markets.

Most recently, TOTSA TotalEnergies Trading was fined $48 million for attempting to manipulate the EBOB gasoline futures market through spoofing - placing fake orders to artificially depress prices and boost short positions. Controlling over 60% of the market volume, TOTSA’s actions had a significant impact, and although the firm partially cooperated, its failure to preserve key WhatsApp communications led to an even steeper penalty. This particular case involved coordination with Swiss (FINMA) and UK (FCA) regulators, demonstrating the interconnected nature of modern commodities trading and the need for international collaboration in identifying and penalising perpetrators.

This is not an isolated incident. Just two months prior, Trafigura Trading LLC faced a $55 million fine for a series of violations, including market manipulation and the misuse of non-public information, as well as actions to obstruct whistleblower communications

Outside of the US, market manipulation fines tend to be levied against individuals, rather than firms. Whilst the magnitude of financial penalties might not match the North American sanctions, regulators are still demonstrating a zero-tolerance attitude toward cases of brazen misconduct.

- Australia: ASIC charged four individuals for conspiracy to commit market rigging and false trading in a pump-and-dump scheme. Using a private Telegram group, they inflated penny stock prices before selling for profit. They face up to 15 years in prison and $1 million in fines.

- Hong Kong: The Securities and Futures Commission (SFC) has intensified its crackdown on market manipulation.

- On 6 August 2024, Cheng Ming was charged with conspiracy to defraud in Hong Kong for his role in a ramp-and-dump scheme. Alongside 11 others facing trial, he is accused of manipulating stock prices to deceive investors. The case follows a joint investigation by the SFC and Hong Kong Police.

- Ms. Sit Yi Ki, Mr. Tam Cheuk Hang, and Ms. Lam Wing Ki received lengthy prison sentences for manipulating Ching Lee Holdings’ shares through false trading, deceiving investors and distorting stock value. This case resulted in the heaviest jail sentence for market manipulation since 2003, with $124.9 million in assets frozen by the SFC.

- In another Hong Kong case, an individual was ordered to disgorge $5.6 million in illicit profits after orchestrating false trading between personal and hedge fund accounts. He was also handed a four-year ban from dealing in securities.

Trade reporting

In Q3 2024, the SEC and CFTC penalised 13 firms for deficiencies in the accuracy and timeliness of trade reporting, with the largest fine of $5 million imposed on The Bank of New York Mellon (BNYM). BNYM was found to have misreported millions of swap transactions and failed to properly supervise its swap dealer operations. In addition to the fine, BNYM must engage an independent compliance consultant to strengthen its trade reporting systems, highlighting regulators’ growing distrust in firms’ ability to manage and remediate controls internally.

How technology solves the eComms regulatory challenge

Regulators are continuing to scrutinise firms that fail to prevent market-related communications on unmonitored channels. This focus is justified: without proper oversight, neither regulators nor firms can detect or prevent market abuse. While an initial solution may seem straightforward - banning or restricting off-channel communications - firms cannot stop there.

Once these communications are moved on-channel, the real challenge begins: extracting signals of suspicious activity from vast amounts of unstructured text data. Failures at this stage won’t just result in ‘recordkeeping fines’ but could lead to other serious repercussions, including failing to prevent market manipulation with tangible, traceable consequences.

eflow addresses this challenge by enabling firms to integrate their trade and eComms data, and analyse them together to provide full context for each trade. TZEC captures the full spectrum of electronic interactions taking place across your firm. It ingests and normalises data from various sources, employing advanced algorithms to detect anomalies and patterns that are indicative of suspicious behaviour, before linking them to relevant trade activity for further analysis. TZEC utilises eflow’s unique Global Lexicon Service so that financial institutions can identify signs of market abuse based on global data and behavioural trends, not just their own limited terms.

Follow these links for more information on eflow’s TZTS Trade Surveillance and TZEC eComms Surveillance solutions, or book a no obligation consultation to speak to one of our experts.