How to prepare for regulatory audits

No financial firm wants to face a regulatory audit unprepared, but in today’s increasingly complex landscape, regulatory audit preparation isn’t optional - it’s a strategic imperative. Whether it’s a full-scope review from the FCA, a focused inspection under MAR rules, or an unannounced inspection as part of a thematic review or enforcement action, the pressure to demonstrate airtight compliance is rising across the UK and EU.

Yet too many firms still rely on manual processes, fragmented systems, and disconnected data, which can lead to delays, missed filings, or fines. Audit preparation has become a board-level concern as regulatory scrutiny intensifies and the cost of non-compliance grows.

Thankfully, with the right structure, tools, and oversight, audit readiness can become a natural part of your compliance workflow, not a last-minute panic. We will now work through a comprehensive checklist for audit preparation: from consolidating data and simulating audits, to ensuring your controls, teams, and documentation are inspection-ready.

Understanding the scope of your audit

Effective regulatory audit preparation starts with understanding the audit’s scope: without this clarity, compliance teams risk wasting time, overlooking critical areas, or facing regulatory pushback. Financial firms encounter a variety of audit types, including:

- Regulatory audits by bodies like the FCA or ESMA

- Thematic audits focused on specific risks (e.g. market abuse, trade surveillance)

- Internal audits by compliance or risk departments

- Third-party audits simulating pre-regulatory reviews

Audits typically fall into one of two categories:

- Full-scope audits: These span multiple regulations and business areas, examining systems, governance, reporting accuracy, and data integrity.

- Issue-specific audits: Targeted reviews of a particular regulation (e.g. MAR, EMIR) or process (e.g. communications monitoring). Industry trends or firm-specific incidents often trigger these.

Clarifying scope allows teams to prioritise relevant data, prepare the correct documentation, and ensure key staff are ready to engage. It also prevents unnecessary preparation and supports a faster, smoother audit process, especially when information must be drawn from multiple systems.

Practical Examples

- Transaction Reporting Audit: Focus on RTS 22 timeliness, data lineage, report logic, and submission logs.

- Market Abuse Surveillance Review: Assess alert thresholds, escalation logs, MAR policy compliance, and review workflows.

The better you understand your audit’s scope, the more efficient and defensible your response will be.

Centralise and consolidate your compliance data

A successful audit starts with knowing what data regulators will ask for, where it’s located, and whether it can be quickly accessed in a usable format. In many firms, this remains a challenge with data fragmentation across systems creating friction, delays, and exposing gaps in audit readiness, especially when tight response timelines are involved.

Key compliance-relevant data sources often include:

- Order Management Systems (OMS) and Execution Management Systems (EMS)

- Trade platforms and regulatory reporting systems (e.g. MiFIR RTS 22 reports on transaction reporting obligations)

- Communication platforms such as email, Teams, WhatsApp, and Bloomberg chat

- Voice and call recording systems

- Market data feeds and external reference points

- Surveillance tools generating alerts under regulations like MAR

Preparing this data manually or pulling it from siloed systems increases the risk of errors, inconsistent formats, and audit trail deficiencies. Common friction points include incomplete communication records, poor traceability of alerts, and system exports that don’t align with audit timelines or formatting standards.

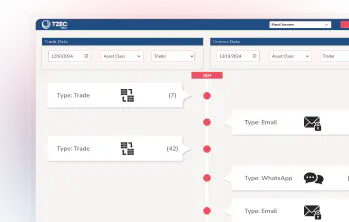

This is where platform-based RegTech solutions like those offered by eflow provide a critical advantage. Our modular platform integrates with all key data sources, enabling automated import, formatting, and consolidation, including structured and unstructured data (e.g., emails or voice logs).

By unifying these sources through a single compliance interface, firms can streamline investigations, produce regulator-ready reports on demand, and improve real-time surveillance outcomes. Strengthening the structure of the underlying audit trail and providing a speedy and accurate response to audit requests/obligations.

Review your surveillance and reporting controls

As part of broader audit preparation, more firms are now proactively reviewing their surveillance and reporting logic to ensure it aligns with regulatory expectations and the structure and scope of likely audits.

Are your trade surveillance thresholds up to date?

Your alert thresholds must reflect current trading volumes, patterns, and investor behaviour. For example, periods of market volatility, shifts in trading strategy, or business model changes may warrant a reassessment. Stale or overly rigid thresholds can also lead to alert fatigue, or worse, missed market abuse indicators.

Have any rules been overridden or manually adjusted?

Regulatory reports must be accurate, timely, and complete. While core rules and triggers should align with the latest regulatory guidance, there may be times when manual overrides or exceptions occur. These must be adequately documented, approved, and logged, forming a self-contained audit trail that can be presented during inspection.

Market abuse scenarios and MAR obligations

Logging alerts for typologies such as insider trading, spoofing, or layering is no longer sufficient. Firms must demonstrate a transparent, end-to-end process from detection to investigation and resolution. Regulators frequently assess whether escalation logs and investigation outcomes are being tracked and reviewed. Consequently, firms should be ready to present this evidence and confirm that ongoing oversight is in place.

Audit trail and documentation readiness

When it comes to audit trails and documentation, all records and version histories must be complete, accurate, and easily accessible. This creates an uninterrupted timeline that enables regulators to trace changes, track improvements, and assess governance over time.

Why audit trails matter

Regardless of the type or depth of audit, a well-maintained audit trail demonstrates apparent oversight and control of your firm’s compliance processes. In the event of a regulatory review or investigation, all relevant information and supporting evidence should be readily available. A consistent record of actions and notifications reduces reliance on individual memory or informal explanations and significantly strengthens your ability to defend against enforcement action.

Key elements of a strong audit trail

At a high level, essential components of an effective audit trail include:

- Timestamps: Every alert review, change, and system update should be timestamped

- Immutable logs: Audit records and timelines should be non-editable once created

- Version histories: Track changes to policies, thresholds, and system logic over time

- User actions: Clear attribution of actions using user IDs and access-level control

A typical audit will also examine supporting documentation such as surveillance review logs, policy updates, and system parameter changes. In addition to evidencing regulatory compliance, these records often assist external consultants conducting internal reviews or audit readiness assessments, making them invaluable even beyond the scope of a formal inspection.

Run a mock audit or simulation

Conducting a mock audit is one of the most effective ways to uncover weaknesses before facing a real regulatory inspection. These internal simulations should be treated with the same rigour as a formal audit, allowing firms to:

- Stress-test internal processes in a controlled, low-risk environment

- Identify compliance vulnerabilities and procedural gaps

- Build team confidence by rehearsing audit roles and response timelines

- Benchmark readiness against industry and regulatory expectations

Mocks can be led by internal compliance teams or conducted with the help of an external third party to provide an objective assessment.

Common Gaps Identified

The goal isn’t to prove perfection but to surface real issues. Common findings include outdated alert parameters, manual reporting workarounds without audit trails, delayed escalation logs, and missing documentation. Addressing these proactively strengthens your regulatory audit preparation and ensures a more confident response in a live audit scenario.

Ensure team readiness and accountability

Testing your internal systems against regulatory and compliance obligations also means assessing team readiness and individual accountability. Many firms use an audit response matrix to clearly define responsibilities, outlining who owns each compliance area, how communication should flow, and who handles follow-ups after an audit.

This approach helps eliminate the “not my department” gaps of the past by ensuring both individual and collective accountability across compliance, operations, and IT. Regular team training sessions also allow managers to update staff on evolving regulatory requirements and reinforce what’s expected during an audit scenario.

While much of the focus around audit preparation is often placed on technology and platforms, it’s important to remember that regulatory compliance is a team effort. Even with the best systems in place, any weakness in communication or decision ownership will be reflected in the outcome of an audit.

Management of changing regulations

Regulatory frameworks constantly evolve, and audit readiness depends on your ability to adapt quickly. From EMIR Refit and ongoing MAR updates, to MiFID II adaptations post-Brexit, firms must ensure their systems reflect the latest rules, not last year’s requirements.

A key question is whether your compliance infrastructure is dynamic or manual. Systems relying on static parameters or manual reconfiguration may fall behind, exposing firms to outdated logic, missed obligations, and audit scrutiny. Regulators increasingly expect close to real-time responsiveness to change, especially when rules are complex and data-intensive.

This is where eflow’s platform-based approach stands out. Our modular system is designed to roll out updates fast to all client systems, ensuring your compliance logic evolves in step with shifting regulations. Clients benefit from automated updates across surveillance thresholds, reporting logic, and audit workflows - without the need for redevelopment or lengthy change cycles.

With eflow, firms gain a compliance framework that meets today’s obligations and adapts rapidly to tomorrow’s rules, keeping you audit-ready and aligned with current regulatory expectations.

Prepare your response protocol

In terms of the intensity of audit preparation, firms often focus on systems and documentation, but response planning is just as critical. A clearly defined communication protocol ensures your team can respond quickly, accurately, and consistently when auditors raise queries.

Assign ownership for responding to audit findings - whether compliance, legal, operations, or a combination - and ensure those individuals understand the scope of their role. Differentiate between internal messaging (staff alignment, risk briefings) and external communication with regulators or stakeholders.

Establish a clear timeline for response, covering:

- Initial audit queries

- Submission of requested evidence

- Follow-up clarifications

- Any remediation reporting required

Without a structured protocol, even strong compliance systems can falter under regulatory scrutiny. This step ensures nothing is missed and demonstrates a mature, proactive compliance posture.

Conclusion

Regulatory audits are no longer rare or routine - they’re an expected part of operating in today’s fast-moving, tightly governed financial markets. Regulatory audit preparation must be proactive, structured, and continuous, from data consolidation and system reviews to team readiness and response protocols. As regulations like MAR, EMIR, and MiFID II evolve, firms need tools and workflows that adapt just as quickly.

At eflow, we’ve spent over 20 years helping financial firms stay one step ahead of regulatory expectations. Our platform-based, modular RegTech solutions are designed to streamline compliance, automate complex workflows, and maintain audit readiness across every part of your operation.

Whether you’re preparing for your next regulatory inspection or building a long-term compliance strategy, eflow offers the technology, expertise, and support to help you meet your obligations with confidence and demonstrate to regulators that you’re not just compliant, but in control.

Contact eflow today to find out how we can help you stay audit-ready, compliant, and confidently prepared for whatever regulators bring next.