Market abuse enforcements: Where are regulators focusing, and what will they do next?

The current state of market abuse enforcement

Market abuse is a term that encompasses a wide range of illicit activities in the financial markets. These activities distort the market’s integrity, undermine investor confidence, and ultimately, negatively impact the economy as a whole. Market abuse can be broadly categorised into two main types: insider trading and market manipulation.

Insider trading refers to the use of non-public, material information to make informed investment decisions, giving the individual an unfair advantage over other market participants. Market manipulation, on the other hand, covers an array of tactics aimed at artificially influencing the price or trading volume of a security. Among many others, these tactics include:

- “Naked” short selling: Selling shares without borrowing them first, leading to a failure to deliver and artificially increasing the supply in the market.

- Spoofing: Placing large fake orders to create false market signals, manipulating the security’s price or trading volume.

- Ramping: Engaging in coordinated buying or spreading positive rumours to artificially inflate a security’s price before selling at a profit.

- Pump & dump schemes: Promoting a security through false or misleading information to drive up its price, and then selling the inflated shares for a profit.

To provide clarity and practical insights on the enforcements against these behaviours, we have explored global regulatory fines on firms for market abuse[1] from 2019-2022, which totalled $1.9 billion across 9 major jurisdictions. To gain further insight into the future priorities and focal points of regulatory bodies, we have also considered qualitative data[2], including consultations and press releases by prominent regulators as well as reports on enforcement action at the individual level.

Are you curious about your own market abuse requirements? Take a look at our trade surveillance solution.

Which regulators have been most active?

The global view

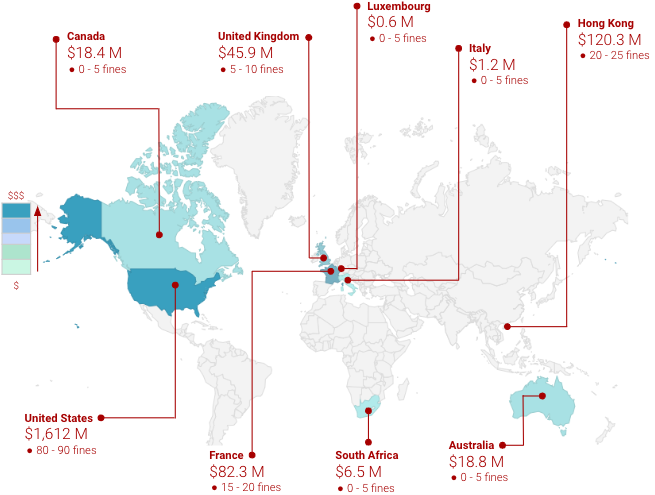

Figure 1 shows that enforcement activity in the US has been the major driver of global market abuse fines on firms from 2019-2022. There are a few probable explanations for this, including the US’ market size, extraterritorial reach, well-resourced and aggressive regulators as well as a few high-profile cases that have skewed the numbers upwards.

Figure 1: Aggregate market abuse fines by jurisdiction, 2019-2022

The relatively lower figures in other regions are equally interesting. It is important to note that while these fines were enforced during this period, they typically relate to crimes which initially took place 5-10 years ago - this is relevant as it implies that there are likely many substantial investigations ongoing across the globe which are yet to be closed. What we can be sure of, however, is that the costs of non-compliance are not captured in full by regulatory enforcements. In addition to regulatory enforcements, non-compliant firms often face considerable challenges, such as:

- Remediation costs: Firms may need to invest heavily in overhauling their systems, processes, and controls to meet regulatory standards and prevent future violations.

- Reputational damage: As news of regulatory breaches becomes public, firms may lose the trust of clients and partners, leading to lost business opportunities and a tarnished brand image.

- Impact on stock prices: When investor confidence is shaken due to regulatory violations, a firm’s stock price can take a hit, adversely affecting its market valuation and shareholder value.

The US view

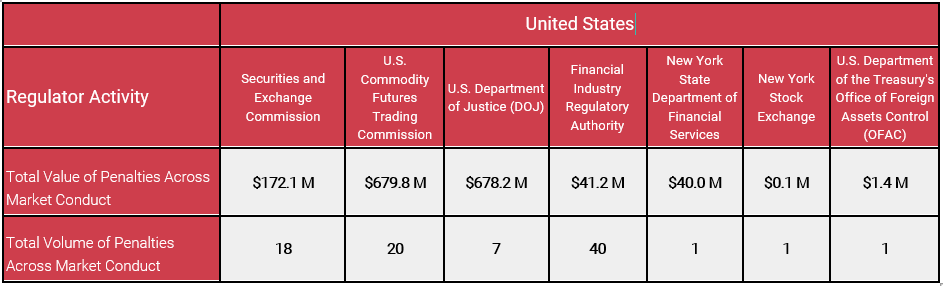

Figure 2 provides a breakdown of the market abuse fines imposed by major US institutions in the relevant period:

Figure 2: Aggregate market abuse fines by jurisdiction, 2019-2022

While the Financial Industry Regulatory Authority (FINRA) has been the most active in terms of the volume of enforcement actions, the US Commodity Futures Trading Commission (CFTC) and the Department of Justice (DOJ) have imposed significantly larger total fines by value. This distinction highlights the different focus areas and enforcement priorities of each regulator.

In some cases, firms are punished by multiple regulators at once. In 2020, the CFTC, DOJ and SEC issued a combined $920 million fine against JPMorgan Chase & Co. for engaging in manipulative and deceptive conduct in the precious metals and U.S. Treasury futures markets. This penalty is the largest ever imposed for spoofing-related misconduct.

Whereas FINRA have been more likely to enforce alone, with a high volume of enforcements below $1 million. These typically include supervisory and procedural oversights, position reporting failures and various short selling violations.

What are firms being fined for?

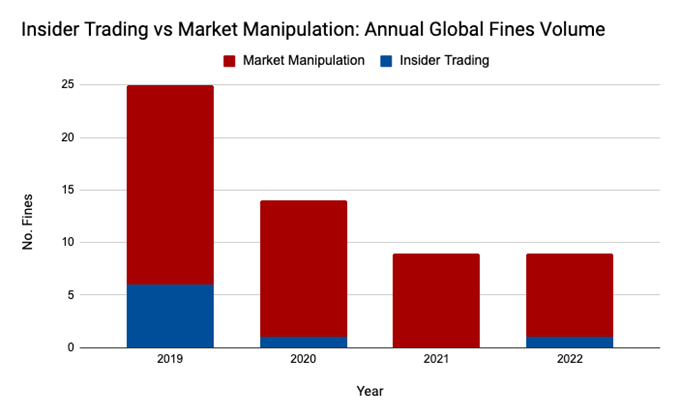

The analysis of market abuse fines from 2019 to 2022 reveals that a large majority of the penalties imposed on firms were for market manipulation violations. See Figure 3:

Figure 3: Aggregate market abuse fines by type, 2019-2022

Interestingly, there have been relatively few fines imposed on firms for insider trading during the same period. One possible explanation for this is that insider trading offences are more likely than market manipulation to be charged at the level of the individual(s) involved.

An example: Liability at the individual level

In 2019, Sean Stewart, a former senior banker at 2 New York investment banks, was sentenced to 24 months in prison by the US DOJ for providing his father with confidential information about five healthcare company acquisitions before public announcements.

However, this is not to say that firms are entirely exempt from the consequences of insider trading, as they can still face reputational damage and increased scrutiny from regulators if their employees are found to have engaged in such activities.

Market manipulation

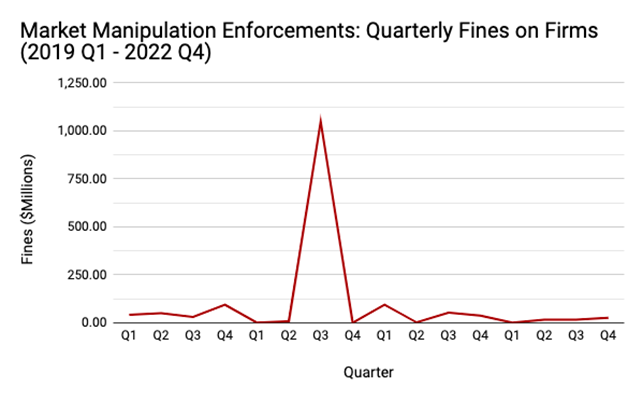

The spike in Q3 2020 shown in Figure 4 reflects the aforementioned landmark enforcement on JPMorgan. Otherwise, quarterly market manipulation fines average out at around $100 million.

Figure 4: Aggregate value of quarterly market manipulation fines

Insider trading

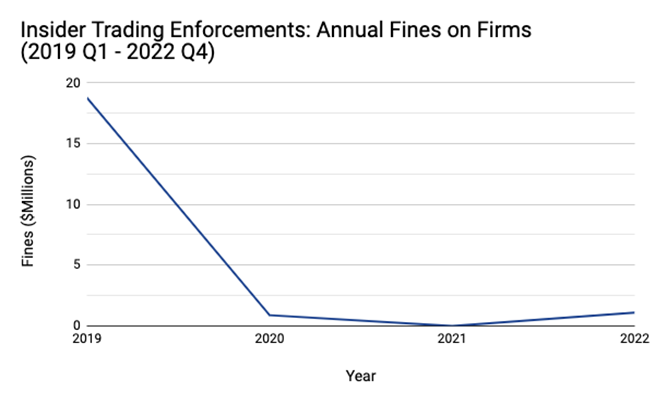

Figure 5 reflects the relatively lower level of Insider Trading enforcements on firms.

Figure 5: Aggregate value of quarterly insider trading fines

2019 saw a relatively higher level of insider trading enforcements, driven by a flurry of activity in Canada. From 2011 to 2013, Ontario Securities Commission (OSC) staff identified hundreds of instances in which Royal Bank of Canada (RBC) and The Toronto-Dominion Bank (TD) FX traders disclosed confidential customer information via chat rooms with traders at competitor firms. RBC and TD paid fines of almost $20 million for failing to prevent these communications.

How are market abuse cases changing?

Recent trends

The most recent year of data shows an increased focus on enforcements pertaining to deficiencies in firms’ systems and controls. Though fines for these offences are relatively lower, they do mark firms as targets for further investigation - a firm which can’t configure or enforce their own systems and controls can barely be expected to have a grip on the full complexity of market abuse. Systems and controls deficiencies, including or leading to poor data quality, also contribute to the difficulty faced by regulators in enforcing larger scale offences by diminishing the evidence available.

The difficulty of proving market abuse

“Insider dealing and market manipulation infringements imply extensive investigations and complex evidence gathering exercises. Sanctioning those infringements is likely to require more work and longer delays than administrative measures imposed for other infringements e.g., breaching the obligation to report the transactions executed under an accepted market practice” (ESMA, 2022)

Looking ahead

By cracking down on systems and controls failures, regulators are setting up a period in which substantial cases will be easier to prove. And to this end they are doing much more. In particular, certain regulators are implementing their own technology to detect market abuse:

- ASIC MAI Platform: Launched in 2018, this online system provides market participants with access to ASIC’s market surveillance data and analysis tools, enhancing market transparency and oversight.

- BaFIN ALMA: A real-time surveillance system designed to monitor and detect potential violations of financial regulations, flagging suspicious transactions and behaviour patterns related to market abuse or fraud.

- SEC ATLAS Initiative: Introduced in 2019, this program leverages advanced data analytics and machine learning to detect potential insider trading and market manipulation, using various data sources like trading data, news feeds, and social media to identify illegal activities.

As technology advances, firms must adapt by employing more sophisticated tools to safeguard themselves against both internal vulnerabilities and rogue individuals. To stay ahead of the regulations and the competition, invest in cutting-edge eComms and Trade Surveillance solutions for a secure and compliant future.