Integrate regulatory data from across your business

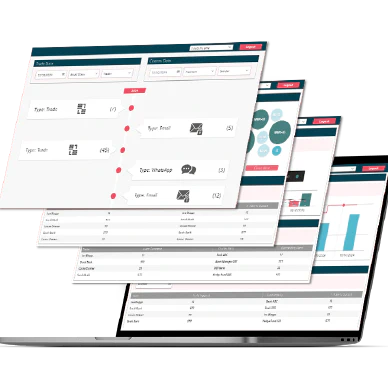

Its highly configurable design means that PATH offers firms a customisable solution that enables your in-house and third-party platforms to communicate with one another seamlessly in real-time, regardless of file format.

Ingest data from multiple sources as part of a holistic regulatory strategy

The eflow Market Data Store (MDS) sources data from hundreds of leading partners, including Refinitiv, Dow Jones, Factset and ICE. Your trades are automatically enriched with data from these sources before being normalised and employing advanced algorithms to detect anomalies and patterns that are indicative of suspicious behaviour.

Connect multiple data sources to increase regulatory transparency

One of PATH’s primary functions is to allow data to flow freely between different sources. Its straight-through processing capabilities means data can be shared between all your in-house and third-party platforms instantaneously, regardless of file format. This means that as your business grows and trading activity increases, your eflow platform can scale with your operation.

Interrogate both structured and unstructured data

eflow’s technology can ingest data from multiple digital sources, including email providers, Microsoft Teams, Slack, Bloomberg messaging, Red Box call recording, and other platforms. It methodically sifts through the complexities of both structured and unstructured data and uses these insights to associate communications with relevant trades when testing for market abuse and market manipulation. In doing so, TZEC highlights not just the content of the messages, but also the intent and context surrounding each trade.

Class-leading regulatory compliance solutions

eflow’s regulatory technology has been engineered with a clearly defined objective in mind; to enable firms to manage their regulatory controls in a more robust, streamlined and efficient way.

Trade Surveillance

Simplify, streamline and strengthen your trade surveillance through the most flexible and feature-rich solution available on the market today.

eComms Surveillance

Generate a comprehensive view of communication channels, identify potentially suspicious behaviour, and make informed, data-led decisions.

Transaction Reporting

Manage all of your transaction reporting obligations from a single platform that automates data reconciliation, error handling and report submission.

Best Execution and TCA

Demonstrate compliance with Best Execution legislation and uncover commercial insights with transaction cost analysis in a single digital solution.