Q2 2025 enforcement update: New signals emerge from the new administration

After a record-breaking 2024, and a fast start to 2025, global enforcement actions finally slowed down in the second quarter. While the value of closed enforcement actions dropped, regulators remained active in other ways, with important signals emerging in the U.S. regarding the priorities of this new administration.

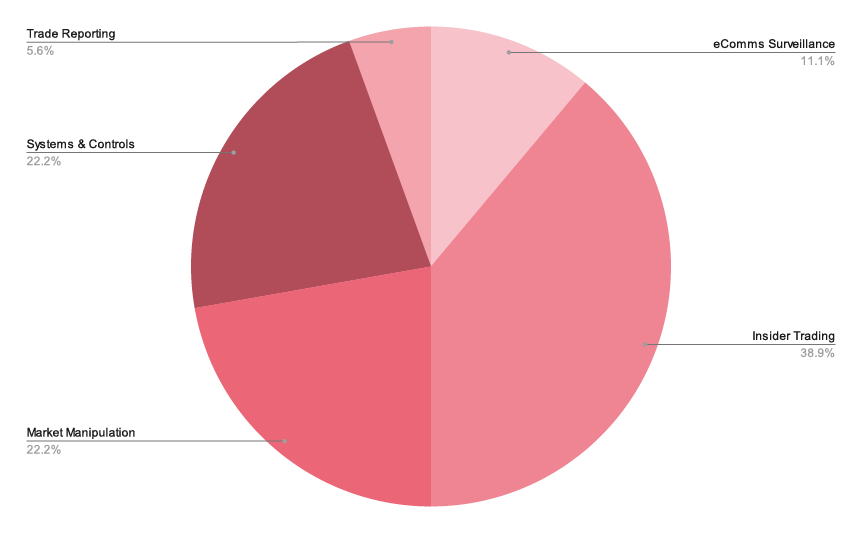

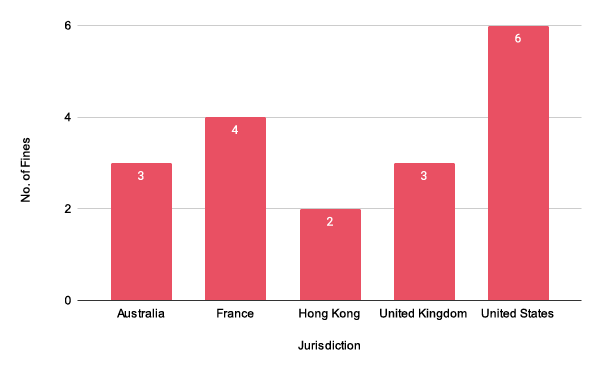

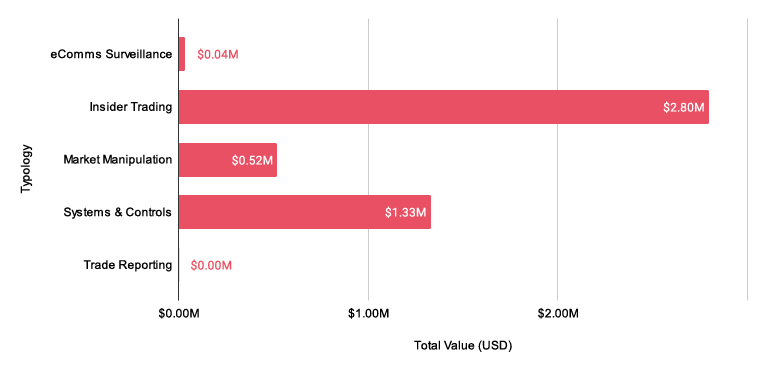

In Q2 2025, there were 18 enforcement actions:

Across six jurisdictions:

Totalling $4.7 million

Keep your eyes on family ties, insider trading enforcements persist

The U.S. had an uncharacteristically quiet quarter, but enforcement continued apace elsewhere. In the UK, the FCA secured convictions in two notable insider trading cases. Both highlight how familial and social circles remain key channels for illicit information sharing.

- Two brothers exploited insider information from brokers to profit from share dealings in several AIM-listed companies.

- An asset management analyst orchestrated a complex scheme involving his sister and associates to profit from confidential deal insights, netting around £1 million via Contracts for Difference (CFDs).

The French AMF took a firm stance with multi-party actions involving individuals and corporations. Fines totalling over €2 million were imposed on European TopSoho, Dynamic Treasure Group, and Ms Qiu for disseminating misleading information and leveraging their inside knowledge for trading gains. Separately, four individuals received substantial penalties for insider trading and unlawful recommendations:

- Ms Pignet-Aiach, CEO of Lysogene, passed confidential information about FDA approval for clinical trials to her ex-husband, Mr Aiach, who used it to acquire shares and shared it with friends and associates. These parties executed trades based on the information, with some also recommending investments to others.

Market manipulation and spoofing: Individuals and firms face stiff sanctions

Market manipulation, especially spoofing and false trading, remains high on regulators’ agendas. The FCA’s successful defence of bans against three traders for spoofing Italian government bond futures demonstrated a willingness to pursue long-running, technically complex cases through to the Upper Tribunal. These fines and bans underline the serious consequences of deceiving the market, even if it is without direct monetary gain.

Spotlight: Global crackdown on finfluencers

In June, the FCA led a coordinated international crackdown on illegal “finfluencers,” working alongside regulators from Australia, Canada, Hong Kong, Italy, and the UAE. The UK’s efforts alone resulted in three arrests, authorised criminal proceedings against three individuals, and over 650 takedown requests targeting unauthorised financial promotions on social media. Social media personalities promoting financial products without authorisation will face real consequences, as regulators worldwide move to protect consumers from misleading online promotions.

Asia-Pacific regulators were equally active. Hong Kong’s SFC banned a former representative for three years after uncovering a pattern of wash trading designed to mask margin call risks. In Australia, ASIC secured guilty pleas from participants in a Telegram-based pump-and-dump ring:

- Over three weeks, the group coordinated nine “pump” announcements to artificially boost share prices, then sold their holdings for profit.

- Each faces significant penalties, including up to 15 years imprisonment and fines over $1 million. The case highlights ASIC’s commitment to cracking down on social media-driven market manipulation.

Systems and controls: U.S. brokers penalised for surveillance failures

FINRA handed down multiple penalties related to deficient systems and trade surveillance in Q2 2025. TP ICAP Global Markets, SpeedRoute, TradeUp Securities, and U.S. Tiger Securities were all cited for failures to detect manipulative trading, such as spoofing, wash trades, and layering.

These cases reveal a persistent gap, first highlighted in our “Global trends in market abuse and trade surveillance” report: even as surveillance technology improves, resourcing and calibration remain weak points, sometimes with only a single employee reviewing thousands of alerts.

FINRA also emphasised the importance of electronic communications retention, penalising several firms and individuals for failing to supervise, record, or retain business communications, including on personal devices.

The big picture

Across jurisdictions, this quarter’s actions reinforce a few core trends: personal and social connections remain vectors for insider dealing, technical manipulation schemes are under sustained scrutiny, and firms that neglect surveillance and reporting systems continue to court regulatory risk. With regulators sharing intelligence and tightening expectations, firms must ensure their controls are both robust and proactive, or risk being the next enforcement headline.

Beyond the numbers: What’s going on in the U.S.?

Following a record-breaking Q1 - in which the SEC and CFTC issued over $100 million in market abuse penalties and announced more than 200 enforcement actions including non-market abuse typologies - Q2 saw activity drop sharply to just 114 total actions, a 43% quarter-on-quarter decline, with no fines at all for market abuse or insider trading.

Much of this deceleration aligns with the first 100 days of a new, Republican-led SEC. In the post-election, pre-inauguration window, the outgoing administration accelerated enforcement, filing 188 actions as they cleared the decks. Since then, the pace has slowed as the SEC has undergone restructuring under new leadership. Much of that work is complete, and the new administration has signalled its intent to crack down on market abuse throughout the rest of the year.

Looking ahead, the SEC has signalled a “back to basics” approach.

At SEC Speaks 2025, senior officials explicitly outlined plans to focus on core enforcement areas: insider trading, accounting and disclosure fraud, market manipulation, and breaches of fiduciary duty. The Division has restructured, consolidating its regional oversight and reorganising specialised units to improve efficiency and management. The new Market Abuse Unit, under Deputy Director Jason Burt, will home in on insider trading rings and sophisticated market manipulation, including activity on alternative trading systems.

Meanwhile, the CFTC has adopted a new approach to enforcement:

April saw the rollout of formal guidance encouraging self-reporting, with a focus on material violations, cases that involve significant client harm or market integrity. Incidents and issues of lower severity are now more likely to be handled internally, signalling a more risk-based, resource-efficient enforcement regime.

The bottom line

The U.S. is entering a new era of enforcement, leaner, more targeted, and laser-focused on high-impact cases, with organisational changes and strategic priorities shaping the regulatory landscape for the remainder of 2025.