Q4 2024 enforcements: A closer look at where regulators took action

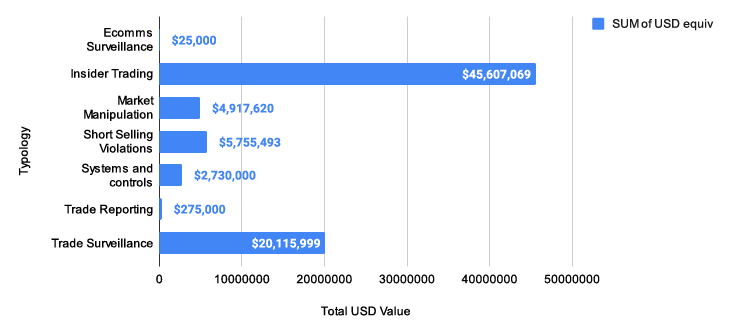

In the fourth quarter of 2024, enforcement action related to market conduct across six jurisdictions reached a combined value of almost $80 million. In this blog, we delve into the detail to see what’s driven this regulatory activity.

Noteworthy cases in Q4 2024

Complex market manipulation unearthed in France

In a decision on 11 December 2024, the Autorité des marchés financiers (AMF), imposed fines totalling €4,150,000 for market manipulation and the dissemination of false or misleading information.

The case revolves around Auplata, its former CEO Didier Tamagno, its auditors RSM Paris, and Pierre Vannineuse, a key figure in the European High Growth Opportunities (EHGO) SF fund. Auplata was found to have misled investors by not disclosing a crucial clause in a financing agreement signed in October 2017. This clause, which impacted the cost of financing, was omitted from the company’s press release, giving investors an inaccurate understanding of the deal. The failure to properly explain the clause, the subsequent earn-outs, and the impact on the company’s going concern analysis in the 2017 financial statements further compounded the misinformation. These actions were attributed to Tamagno’s oversight as CEO and RSM Paris’ failure to identify the discrepancies during the audit.

The enforcement also found that the EHGO SF fund, led by Vannineuse, engaged in price manipulation by selling a significant number of Auplata shares, disregarding commitments to retain shares and limit the volume of sales. This unauthorized disposal of shares distorted market prices and violated public communication norms. As a result, both the fund’s management entities, European High Growth Opportunities Manco SA and Alpha Blue Ocean Inc., along with Vannineuse, were fined for their involvement in the manipulation of Auplata’s share price. The fines, ranging from €50,000 to €1,500,000, reflect the severity of the misconduct.

Landmark insider trading case concluded in Hong Kong

On November 28, 2024, Hong Kong’s Market Misconduct Tribunal (MMT) sanctioned Li Han Chun, former CEO of China Forestry Holdings, and his investment vehicle, Top Wisdom Overseas Holdings, for insider trading and false disclosures. The tribunal ordered them to disgorge $353 million (~$45M USD), reflecting profits avoided through the illegal sale of 119 million China Forestry shares in early 2011.

The tribunal found that Li Han Chun and former chairman Li Kwok Cheong knowingly authorised false or misleading statements in China Forestry’s IPO prospectus, 2009 financial reports, and annual results announcements. These documents overstated revenue by up to 99.99% and concealed fraudulent activities, including falsified forestry rights certificates, fake customer transactions, and fabricated bank statements.

The insider trading occurred after Li Han Chun attended a December 2010 pre-audit meeting with auditors KPMG, where he learned that the company’s rampant falsifications were likely to be exposed. Acting on this knowledge, Li Han Chun sold his holdings through a share placement, avoiding significant financial losses as the company’s stock faced imminent collapse.

Both executives were barred from serving as directors or managers in Hong Kong corporations and from trading securities for five years. They were also ordered to cover legal costs incurred by the Government and Securities and Futures Commission (SFC).

Systems and controls come under scrutiny in the UK

When it comes to risk management, no one can afford to be complacent. Regulators have continued to pursue what are commonly referred to as “gatekeeper failures” this year. We have seen multiple high-profile cases in which control weaknesses have allowed suspicious trades to fly under the radar, and the FCA highlighted one more case to round out the year.

‘MBL’s ineffective systems and controls meant that one of its employees could, at least for a time, hide trading losses which cost the firm millions to unwind.’

Financial Conduct Authority

On 26 November 2024, the FCA fined Macquarie Bank Limited (MBL) £13 million for serious control failures that allowed a trader to conceal over 400 fictitious trades. Between June 2020 and February 2022, a trader on MBL’s London Metals and Bulks Trading Desk, recorded fictitious trades in an attempt to hide his trading losses. These trades went undetected due to significant weaknesses in MBL’s systems and controls, which the bank had been previously warned about but failed to address in a timely manner.

The lack of effective internal controls allowed a relatively junior employee to bypass three key safeguards for over 20 months. As a result, the fictitious trades cost MBL approximately USD $57.8 million to unwind, although they did not affect customers or the wider market. The FCA also banned the individual from the financial services industry for acting dishonestly, and they would have been fined £72,000 had their application for financial hardship not been successful. The case highlights the importance of robust internal controls to detect and address risks early, especially risks originating within the organisation.

‘This should serve as an example to those we regulate; risk can come from within. You need the right systems to identify it so it can be tackled early.’

Financial Conduct Authority

Short selling violations in the US

Q4 2024 also saw an uptick in short selling cases, particularly in the US:

- In November 2024, the SEC charged FiveT Capital AG for violating Rule 105 by buying stocks in public offerings for advisory clients while short selling the same stocks during a prohibited period. The firm agreed to cease and desist from these violations and pay a total of $1,593,294.73 in disgorgement, $357,199.05 in prejudgment interest, and a civil penalty of $805,000.

- In December, FINRA imposed a $3 million fine on J.P. Morgan Securities for inaccurately reporting short interest positions over a period from June 2008 to August 2024. The inaccurate reporting involved approximately 820,000 short interest positions with around 77 billion shares, stemming from multiple causes impacting the firm’s short interest reporting at different times.

- In an ongoing case against Andrew Left and Citron Capital, the SEC and DOJ have levied charges for a $20 million fraud scheme, emphasising a concerning risk typology — “short-and-distort” campaigns. In these cases, traders short stocks and then deliberately spread false or disparaging rumors to drive the stock price down, profiting from the misinformation. This case highlights the ongoing threat posed by such manipulative strategies, where market participants leverage market rumors to further their financial interests, undermining both market integrity and investor confidence.

Our thoughts

Regulators are sharpening their focus on firms that fail to detect and address complex misconduct in real-time. But detecting suspicious activity is no longer simply about identifying a handful of flagrant violations, it’s about spotting subtle patterns that indicate deliberate manipulation, such as the “short-and-distort” scheme highlighted above. The challenge lies not only in capturing this activity but in proving the links between trades, false information, and price movements.

To address this, firms must go beyond traditional monitoring tools. Advanced surveillance platforms that leverage relational mapping and data analytics are becoming essential. By integrating diverse data streams - communications, disclosures, and trading activity - these systems can identify and track suspicious behaviours across the full scope of market interactions and provide a clearer picture of intent. Without such comprehensive systems, firms risk not only regulatory fines but a serious erosion of market integrity, as manipulative practices continue to undermine investor confidence.

For more information on eflow’s regulatory technology and how it can enable firms to combat the threat of market abuse, click here.