SEBI's latest circular: Strengthening AMC to combat market abuse and front-running

Background

Striking the right balance between stringent oversight and operational flexibility is a difficult but necessary endeavour. In 2020, The Securities and Exchange Board of India (SEBI) introduced rigorous regulations mandating that all communications by Asset Management Companies (AMCs) during market hours be conducted through recorded channels, including personal and face-to-face interactions. This measure was aimed at curbing market abuses such as insider trading, front-running and fraudulent transactions. However, while these regulations have been effective in deterring misconduct, they have also been perceived as overly restrictive by the mutual fund industry, impacting the operational efficiency of AMCs.

Time for change

Recognising these concerns, SEBI is now contemplating a nuanced approach that would relax the stringent communication recording requirements while simultaneously strengthening the internal controls and trade surveillance mechanisms within AMCs. The proposed amendments aim to balance operational efficiency with the need to safeguard against market abuse. This blog explains these amendments, exploring how SEBI plans to maintain market integrity while addressing the operational needs of the industry, and what this means for the future of mutual fund regulation in India.

The proposed amendments

The current Indian regulations emphasise integrity, transparency, and accountability, but lack a structured institutional mechanism to detect and otherwise deter market abuse. SEBI’s proposed amendments aim to bridge this gap by requiring AMCs to implement robust surveillance systems, whistleblower policies, and senior management oversight. The ultimate aim is to enhance market integrity while aligning India’s regulatory framework with international best practices.

Stricter mechanisms for identifying and preventing market abuse

On 05 August, SEBI released their latest Circular, containing more detailed proposals for amending the Mutual Fund Regulations to require AMCs to establish a structured institutional mechanism aimed at identifying and deterring market abuse. This proposal stems from recent incidents of misconduct within AMCs1, highlighting the need for proactive measures. The mechanism will include enhanced surveillance systems, internal controls, and escalation processes to detect and address unethical practices such as insider trading and misuse of sensitive information:

Alert-based surveillance: AMCs must develop and implement systems that generate and process alerts promptly, ensuring “timely” identification of potential market abuse.

Processing alerts: During the review of alerts, AMCs should consider all recorded communications, including chats, emails, and access logs from the dealing room, as well as CCTV footage if available. Entry logs to the premises should also be monitored.

Standard operating procedures (SOPs): AMCs are required to establish written policies and procedures for investigating and addressing potential market abuse, such as front-running and manipulative or fraudulent transactions. These SOPs must be approved by the AMC’s Board of Directors.

Action on suspicious alerts: Upon detecting potential market abuse, AMCs should take appropriate actions, which may include suspending or terminating the involved employees or brokers.

Escalation process: AMCs must have a clear process to promptly escalate instances of potential market abuse to their Board of Directors and Trustees, including the results of their internal investigations.

Periodic review: AMCs should regularly review and update their surveillance procedures and systems to ensure they remain effective over time.

Data sharing with exchanges: For better surveillance, stock exchanges and depositories, in coordination with AMFI, should establish systems to share relevant trade data with AMCs.

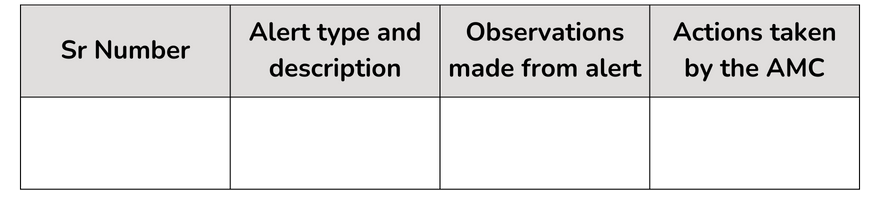

Reporting to SEBI: AMCs must report all examined alerts and the corresponding actions taken to SEBI in their Compliance Test Report (CTR) and Half-Yearly Trustee Report (HYTR) in the following format:

Detailed implementation standards will be supplied in consultation between The Association of Mutual Funds in India (AMFI) and SEBI by August 20, 2024.

Senior manager accountabilityThe proposed amendments would also enhance accountability by making the AMC’s Chief Executive Officer (or equivalent) and Chief Compliance Officer responsible for the implementation and effective functioning of the institutional mechanism for market abuse prevention. This amendment aims to ensure that senior management actively oversees and ensures compliance, fostering a culture of accountability throughout the AMC.

Whistleblower policy

The proposals would mandate the implementation of a whistleblower policy within AMCs. This policy would allow employees and stakeholders to report unethical practices or potential market abuse anonymously and safely, with assured confidentiality and protection for whistleblowers. The amendment aims to create a secure environment for reporting concerns, enabling AMCs to detect and address unethical behaviour and market abuse more effectively.

Subsequent relaxation of electronic communications surveillance

By introducing the aforementioned mechanisms, SEBI hopes to create a robust regulatory environment in which they can relax communications recording requirements for FMDs. While the current regulations mandate recording to prevent market abuse, industry participants have highlighted challenges, particularly during face-to-face meetings and external interactions. SEBI suggests exempting such in-person communications from recording requirements, provided that existing communication safeguards remain in place. This relaxation is contingent upon implementing a robust institutional mechanism within AMCs, ensuring continued market integrity despite the relaxed recording rules.

Conclusion

For India, these changes signify a move towards a more mature, principles-based regulatory regime that supports innovation and growth in the financial sector while ensuring that the highest standards of market integrity are maintained. It underscores India’s commitment to maintaining a regulatory environment that is not only robust and resilient but also flexible enough to adapt to new market realities. This approach mirrors global regulatory trends, where the focus is increasingly on creating frameworks that are both effective and adaptable.

As financial markets and adjacent technologies become more complex and interconnected, the need for sophisticated regulatory mechanisms that can preemptively detect and deter misconduct becomes ever more critical. The global regulatory environment is therefore likely to see a continued emphasis on transparency, technological integration, and institutional responsibility. SEBI’s approach provides a blueprint for how emerging markets can balance stringent oversight with the need for operational flexibility, ensuring that market integrity is preserved in an era of rapid innovation.