The FCA’s 5-year strategy: What it means for trade surveillance, market abuse, and the RegTech frontier

The UK regulator’s new 5-year strategy embraces technology like never before. Here’s why that matters - and how firms can align with the FCA’s smarter, faster, more collaborative approach to compliance.

A new chapter for regulation - and for RegTech

The Financial Conduct Authority (FCA) has published its 2025–2030 strategy, and one thing is clear: the regulator is placing a bold bet on technology.

In fact, across its four core priorities - becoming a smarter regulator, supporting growth, helping consumers, and fighting crime - technology is a central theme that runs throughout. The FCA is leaning into innovation, digitisation, and data-driven decision-making to an unprecedented extent.

For financial institutions operating in capital markets, especially those facing mounting pressures around trade surveillance and market abuse, this shift brings both opportunity and accountability. And for RegTech providers like eflow, it’s validation of what we’ve long believed: that smart, adaptive technology is essential to modern compliance.

The FCA as a tech-forward regulator

In a break from risk-averse convention, the FCA strategy explicitly calls for a “smarter” and more “proportionate” regulatory model - one that embraces technology both within the regulator itself and across the firms it oversees.

As part of this transformation, the FCA has committed to:

- Digitising its authorisations process to improve speed, consistency and ease of engagement.

- Reducing regulatory friction by only asking for the data it truly needs.

- Sharing supervisory insights more openly to allow firms to learn from each other.

- Using AI and advanced analytics to detect market abuse and anomalies faster.

For firms under the FCA’s watch - particularly those in wholesale and high-frequency trading markets - this means scrutiny is going digital. Firms will be expected to move at the same pace that the regulator now demands of itself.

Surveillance, volatility, and the risk rebalance

Perhaps the most consequential concept in the FCA’s new strategy is its call to “rebalance risk.” The idea? That overly cautious regulation can stifle innovation, and that healthy markets require space for informed risk-taking - as long as controls are fit for purpose.

The FCA explicitly acknowledges that emerging technologies like AI can lead to:

- Greater market efficiency through faster reactions to new information;

- But also greater risk - especially increased volatility and susceptibility to market abuse.

This duality puts surveillance and conduct controls squarely in the spotlight. As markets evolve and trading becomes more dynamic, static or one-size-fits-all monitoring frameworks won’t cut it. Firms need surveillance systems that can:

- Dynamically recalibrate thresholds across asset classes and trading venues;

- Detect sophisticated abuse typologies like layering, spoofing, and cross-product manipulation;

- Respond to increased volumes and complexity with real-time insight.

From enforcement to enablement

Another standout in the FCA’s strategy is its shift from punitive enforcement toward earlier, more collaborative engagement with firms.

Instead of saving its scrutiny for the point of failure, the FCA wants to be:

- More predictable in its supervision;

- More open in communicating risks;

- And more supportive of firms seeking to do the right thing.

This echoes a broader regulatory trend we’ve seen globally - in the U.S., for example, both the CFTC and SEC have offered tangible incentives for self-reporting and early cooperation.

In this new enforcement era, it’s not enough to “have a policy.” Firms must show:

- That they can detect misconduct early;

- That they maintain clear audit trails of internal investigations;

- That they escalate and remediate issues swiftly;

- And that they can present a transparent, data-backed story to regulators when needed.

In our recent report on global trends in market abuse and trade surveillance, we made five predictions for 2025. The first prediction, that regulatory oversight will evolve, has been validated even quicker than we had expected.

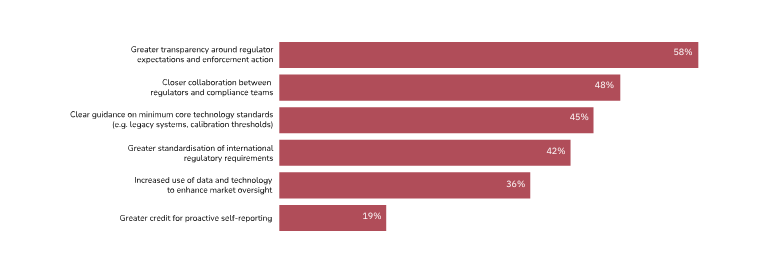

Our conviction was developed in part by listening to the market. Of the 300 regulatory executives surveyed across five different jurisdictions, 59% said that “greater transparency around regulator expectations and enforcement action” was how regulators could better support their firm.

Fighting crime with technology

The FCA’s renewed commitment to fighting crime comes with a clear mandate: use technology to do it better.

The regulator is already:

- Using machine learning to detect abnormal trading;

- Partnering with over 60 data and tech suppliers;

- Actively exploring how generative AI can support decision-making;

- Investing in its own SupTech infrastructure, including more advanced internal analytics and digital platforms.

Crucially, the FCA isn’t going it alone. It sees the firms it regulates as vital partners - and RegTech as a crucial enabler. In their own words, they want to “support firms in drawing on new, developing technology” to strengthen controls and reduce cost.

Prediction 4 of our recent report is also aging well:

“As we look ahead to 2025 and beyond, market abuse surveillance will undergo significant transformation, driven by advancements in AI and machine learning. The adoption of AI by regulators themselves signals a paradigm shift - one that will see firms facing heightened scrutiny over their own AI implementations. In response, surveillance tools will not only become more sophisticated but will also shift towards predictive and adaptive frameworks that proactively identify emerging risks rather than reactively responding to past behaviours.”

This alignment couldn’t be clearer. Firms that invest in surveillance platforms with adaptive intelligence and demonstrable value will be best placed to meet the FCA’s expectations—and to become trusted partners in the fight against market abuse.

Surveillance that moves at the speed of change

With financial markets undergoing constant transformation - structurally, technologically, and geopolitically - the one constant is change. And regulators are catching up.

The FCA’s strategy represents a new kind of regulation: agile, data-driven, and ready to work with firms rather than only acting against them. But this shift comes with higher expectations, especially for firms operating in fast-moving, abuse-prone markets.

At eflow, we believe that compliance shouldn’t be a brake on growth - it should be a catalyst. That’s why we’ve built our surveillance solutions to adapt in real-time, reflect market complexity, and give firms the tools to meet evolving regulatory demands head-on.

As the FCA ushers in a more tech-positive era of supervision, the message is clear: surveillance and conduct systems aren’t just support functions. They are strategic assets.

Follow these links to find out more about eflow’s solutions for trade surveillance, eComms surveillance, best execution and transaction reporting can help your firm’s regulatory strategy.