The SEC’s record-breaking enforcement results for the fiscal year 2024

The Securities and Exchange Commission (SEC) has unveiled its enforcement results for fiscal year 2024, and the numbers tell a clear story. With a record-breaking $8.2 billion in financial remedies secured, the agency continues to solidify its role as a key enforcer of market integrity and investor protection. These results reflect not only the SEC’s ability to take on complex, high-impact cases but also its evolving focus on areas of systemic risk and emerging market challenges.

The financial penalties issued this year are especially striking when compared to the overall decline in the number of enforcement actions. This trend suggests a shift in strategy: a greater focus on higher stakes, higher impact cases.

The SEC’s enforcement activities shape the regulatory landscape, set precedents, and influence how firms approach their compliance obligations. For compliance professionals and market participants, understanding these trends is crucial for staying compliant and prepared for regulatory shifts. This blog explores some of the key themes that defined the SEC’s actions and offers insights into what these developments mean for the future of financial regulation.

Quantitative overview: The numbers that define FY 2024

“In fiscal year 2024, the Division continued to vigorously enforce the federal securities laws by recommending to the Commission high-impact enforcement actions addressing non-compliance throughout the securities industry and resulting in robust financial remedies”

Sanjay Wadhwa, Acting Director of the SEC’s Division of Enforcement.

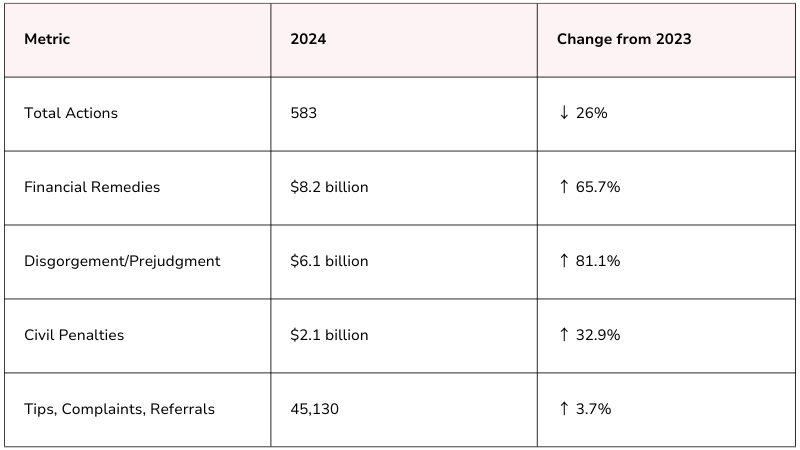

This data underscores the SEC’s strategic pivot in fiscal year 2024, prioritising fewer but more impactful enforcement actions. While the total number of actions dropped significantly, the record-breaking $8.2 billion in financial remedies - an increase of 65.7% from 2023 - demonstrates a focus on high-stakes cases with substantial consequences.

The sharp rise in disgorgement and prejudgment interest (81.1%) highlights the SEC’s determination to strip ill-gotten gains, while the increase in civil penalties (32.9%) reinforces its commitment to punitive measures. The slight uptick in tips, complaints, and referrals (+3.7%) reflects a steady and continued increase in public engagement against market abuse.

Key cases: Illustrating quality over quantity

The SEC’s focus on impactful cases is exemplified by several landmark settlements:

- Terraform Labs ($4.5 Billion): One of the largest securities fraud judgments ever, involving deceptive practices in crypto assets, reinforcing the SEC’s oversight of digital asset securities.

- FirstEnergy Corp. ($100 Million): A bribery scheme involving payments to a legislator to secure favorable regulatory actions.

- SAP ($98 Million): Foreign Corrupt Practices Act violations across multiple jurisdictions.

- Macquarie ($79.8 Million): Improper cross trades and overvaluation of illiquid assets, violating fiduciary duties.

Thematic trends: What defined FY 2024 enforcement?

Emerging risks

The SEC demonstrated agility in tackling risks tied to emerging technologies and financial products:

- Artificial intelligence: The SEC pursued firms like QZ Asset Management for falsely marketing AI-driven strategies. In a separatespeech titled “AI, Finance, Movies, and the Law” Chair Gary Gensler warned against “AI-washing” – exaggerated claims about AI capabilities – emphasizing truthful, specific disclosures to maintain investor trust.

- Cryptocurrency: High-profile crypto frauds like HyperFund ($1.7 billion) and NovaTech ($650 million) were dismantled, alongside compliance failures such as Silvergate Capital’s inadequate AML oversight. The SEC praised their “advanced data analytics and technology”, including crypto asset tracing, which proved instrumental in uncovering fraud, even in cases involving sophisticated international hacking.

- Cybersecurity: Cases against entities like the NYSE for failing to report cyber breaches emphasized the SEC’s insistence on robust data protection and prompt disclosure.

Market abuse and insider trading

The Division investigated potential abuse of material non-public information (MNPI), resulting in some groundbreaking enforcements addressing a range of violations;

- Morgan Stanley: Morgan Stanley & Co. LLC (fined $249m) and the former head of its equity syndicate desk, Pawan Passi (fined $250,000), with a multi-year fraud involving the disclosure of confidential information about the sale of large quantities of stock known as “block trades.”

Insider trading and market manipulation

The SEC’s charges against Morgan Stanley and Pawan Passi involve both insider trading and market manipulation, primarily stemming from the misuse of MNPI about upcoming block trades. By leaking this information to select investors, Morgan Stanley enabled them to pre-position trades, such as short-selling, which distorted market dynamics and created an unfair advantage. While the case exhibits elements of both insider trading and manipulation, the core violation lies in the unauthorized disclosure of MNPI, breaching confidentiality agreements and securities laws.

- SEC v. Panuwat: This precedent-setting insider trading case involved trading in a peer company based on confidential acquisition information, expanding the scope of insider trading enforcement.

Encouraging proactive compliance

In FY 2024, the SEC repeatedly emphasized the value of proactive compliance, both verbally and through action, commending the public companies, investment adviser, and broker-dealers that stepped forward to self-report and remediate securities law violations.

“The bottom line is this: you’re likely to experience better outcomes with cooperation than without it.”

Gurbir S. Grewal, Former Director, Division of Enforcement

Those entities that meaningfully cooperated with the Division’s investigations benefitted from significantly reduced penalties - or in some cases, no penalties at all - demonstrating the SEC’s commitment to fostering a culture of transparency and accountability. Even large firms were able to achieve favorable resolutions by taking early, corrective action, reinforcing the importance of proactive measures in mitigating regulatory risks.

The SEC’s whistleblower program also saw record engagement, with $255 million awarded and over 45,000 tips received. A notable $18 million penalty against J.P. Morgan for whistleblower retaliation reinforced the agency’s resolve to protect those exposing misconduct.

Charting the SEC’s next chapter

The SEC is poised for a period of transformation as it transitions to new leadership, likely bringing a temporary slowdown in enforcement activity. Leadership changes often necessitate recalibration, with priorities reshaped to reflect evolving directives.

Under the previous leadership, the SEC pursued aggressive enforcement actions, particularly in the cryptocurrency space, which drew both praise for its vigilance and criticism for perceived overreach. As the agency looks ahead, there is potential for a more measured and nuanced approach to crypto enforcement, focusing on clearer guidance and targeted interventions.

Simultaneously, the SEC may seize this opportunity to refocus its efforts on more traditional areas of concern, such as financial reporting, insider trading, and market manipulation - long-standing pillars of its regulatory mandate.

This period of transition offers the SEC a chance not only to refine its enforcement agenda but also to explore innovative approaches that balance robust regulation with fostering a climate of financial innovation.