TZBE Best Execution & TCA Solution

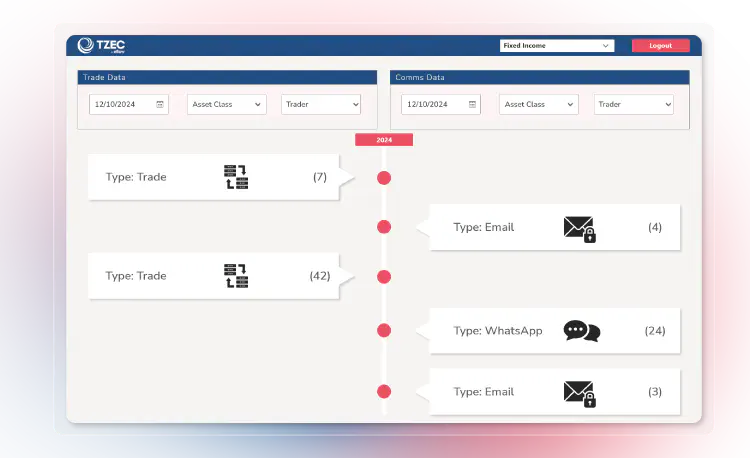

TZBE is eflow’s Best Execution software and Transaction Cost Analysis (TCA) tool. With the ever-increasing variety of trading platforms, instruments and asset classes, using manual processes to satisfy your Best Execution obligations is no longer a viable option. The TZBE platform offers your firm a configurable best execution solution to comply with this legislation quickly, efficiently and accurately.

Demonstrate compliance with Best Execution legislation while uncovering commercial insights

The ability of a firm to demonstrate that it’s acting in the best interests of clients is a core responsibility of any compliance team. TZBE enables you to meet these obligations by automating best execution monitoring, enriching trade data with market information curated from over 250 sources, and generating highly detailed TCA reports.

Not only that, TZBE can also generate commercial insights by highlighting how your trading strategy can be executed more effectively.

How TZBE adds value to your regulatory strategy

TZBE enables financial institutions to satisfy their regulatory obligations under Best Execution legislation, such as MiFID II in Europe, and SEC 606 and FINRA Rule 5310 in North America. Given the scale and variety of trading activity undertaken by many firms, a digital solution is essential to ingest and analyse the multiple data points that need to be monitored to ensure compliance.

TZBE’s highly customisable structure means that it can scale and flex with your business requirements. Your platform will be capable of ingesting, testing and reporting on all major instrument types and asset classes, while automatically running industry benchmarking tests including VWAP, Time, Venue, Implementation Shortfall/Slippage, and Best Bid/Ask.

The platform features highly configurable parameters that can be customised and tested to mirror your trading strategy, automatically account for variables, and reduce false positives. Your chosen reports can also be set based on a number of reference and market data metrics such as volatility and instrument liquidity. Should a trade deviate from expected parameters, it will be flagged for further analysis, enabling the production of detailed TCA reports that highlight areas requiring attention. TZBE also includes MiFID II-compliant data archiving and indexing as standard to ensure that you are one step ahead of your regulatory obligations.

Drive operational efficiency

Use data to trade more effectively

A system that evolves with your strategy

Strengthen your regulatory processes

Automate your record keeping

Tailor the system to your specific needs

A best execution solution that evolves with your business

Data-led trading insights

Generate data-led insights that highlight how your trading strategy could be executed more effectively

Integrated testing and analysis

Automatically run best execution tests and transaction cost analysis through one integrated platform

Automated data enrichment

Automated data enrichment for all alerts and asset types from the eflow Market Data Store which curates data from more than 250 sources

Test against industry benchmarks

Run best execution tests against VWAP, Time, Venue, Implementation Shortfall/Slippage, Best Bid/Ask and more

Highly configurable test parameters

Automatically adjust test parameters to account for any variable and customise alerts in line with your risk strategy

Automated data archiving and indexing

Automatically archive and index trade data in compliance with Best Execution legislation such as MiFID II, FINRA Rule 5310 and MAS Best Execution rules

Comprehensive reporting

Generate ‘regulator-ready’ reports directly from your platform

Asset class agnostic

Ingest, test and generate alerts for all major asset classes

SEC 606 reporting

Meet your firm’s SEC 606 reporting requirements with confidence and accuracy

We have been consistently impressed with eflow’s constant dedication to ensuring that our compliance needs are met. We would recommend them to any firm looking for a market abuse or best execution solution.

The latest regulatory insights

Read our experts’ views on the latest developments in regulation, market abuse, trade surveillance, and much more.