TZEC - A leading eComms Surveillance solution

TZEC is a multi-channel eComms surveillance system that enables firms to monitor and archive various communication channels, identify potentially suspicious behaviour, and make informed, data-led decisions. Using cutting edge eComms monitoring technology, TZEC highlights not just the content of messages, but also the intent and context surrounding each trade.

Centralised eComms monitoring from a single digital hub

In the last five years, global regulators have handed out nearly $3.2 billion in fines to firms that have failed to demonstrate suitable eComms surveillance strategies. Digital messages can be the first sign of potentially high-risk behaviour, and regulators want to ensure that firms are monitoring these interactions and linking them to abusive trading.

TZEC captures the full spectrum of electronic interactions taking place across your firm. It ingests and normalises data from various sources, employing advanced algorithms to detect anomalies and patterns that are indicative of suspicious behaviour before linking them to relevant trade activity for further analysis.

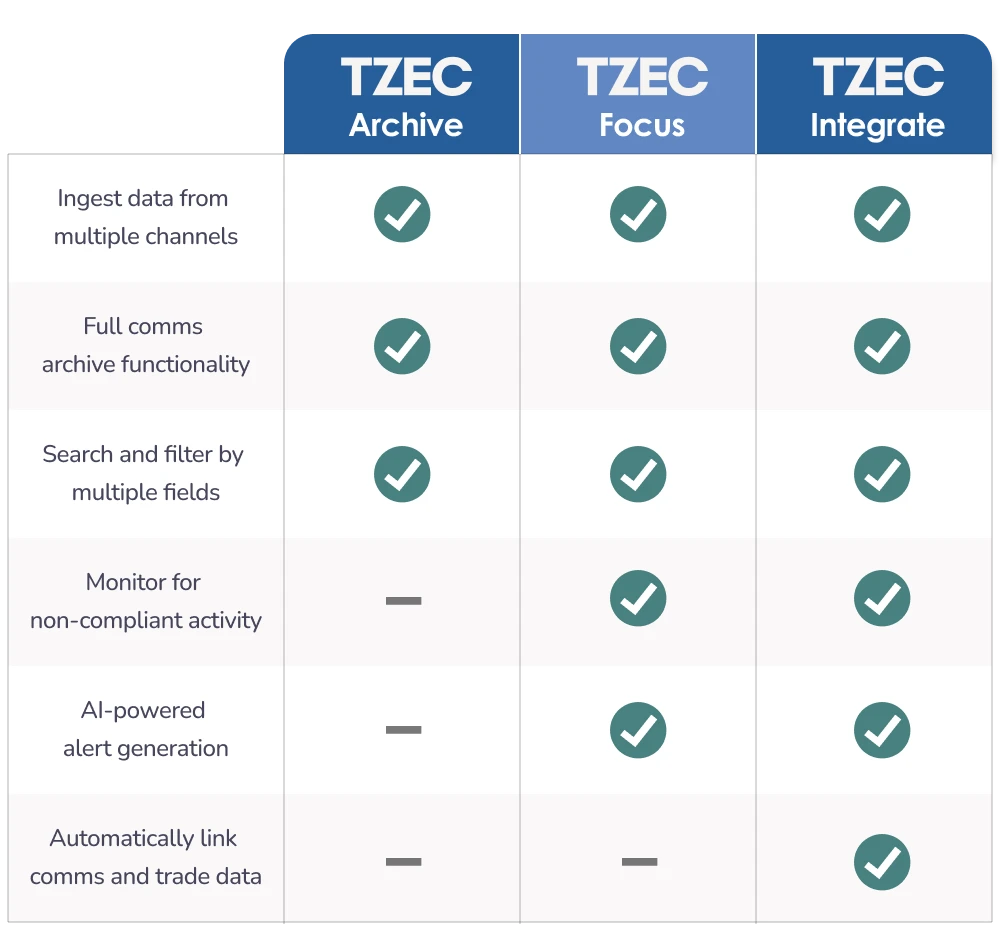

Firms can choose from a menu of modular solutions, all of which have been engineered to meet specific regulatory objectives. From automated data archiving and reporting solutions, through to fully integrated, AI-powered trade and eComms surveillance, TZEC provides a depth and breadth of regulatory governance that is simply unmatched.

TZEC Archive - An efficient, low cost eComms archiving solution

Robust, secure data archiving

Save time, money and effort

Find the data you need at the click of a button

TZEC Focus - AI-powered eComms surveillance

Streamline your comms surveillance

Surveil all data types

AI-powered insights

Regulator ready record-keeping

Identify non-compliant communications quicker

Save time, money and effort

TZEC Integrate - Holistic comms and trade surveillance

A holistic approach to trade surveillance

Proactive compliance based on AI insights

Save time, money and effort

Generate context-rich alerts

Technology that learns with you

Future proof your surveillance strategy

eflow’s commitment to product development as regulation changes stands out amongst its competitors. With eflow we are confident that we have a partner that will evolve as our requirements also evolve.

Linking eComms and trade surveillance eBook

Integrating eComms and trade surveillance

Blog

In recent years, greater regulatory scrutiny has highlighted the need for a more holistic approach to trade surveillance. This eBook explores the potential of performing eComms and trade surveillance in tandem and how firms can get on the regulatory front foot.