TZEC - A leading eComms Surveillance solution

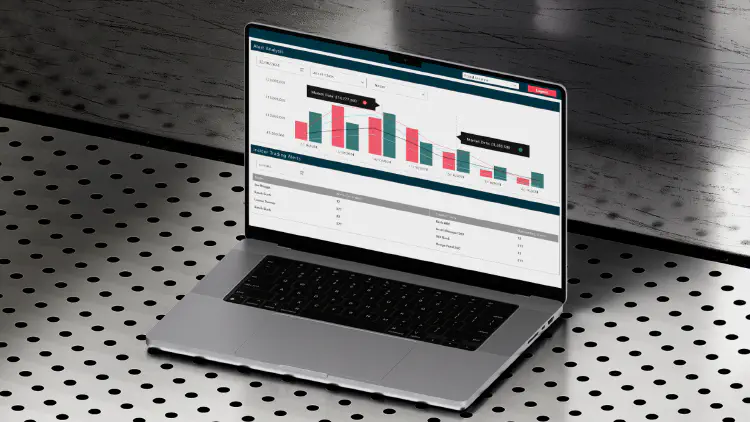

TZEC is a multi-channel eComms surveillance system that enables firms to generate a comprehensive view of various communication channels, identify potentially suspicious behaviour, and make informed, data-led decisions. Using cutting edge eComms monitoring technology, TZEC highlights not just the content of messages, but also the intent and context surrounding each trade.

Centralised eComms monitoring from a single hub

In the last five years, global regulators have handed out nearly $3.2 billion in fines to firms that have failed to demonstrate suitable eComms surveillance strategies.

Digital messages can be the first sign of potentially high-risk behaviour, and regulators want to ensure that firms are monitoring these interactions and linking them to abusive trading.

TZEC captures the full spectrum of electronic interactions taking place across your firm. It ingests and normalises data from various sources, employing advanced algorithms to detect anomalies and patterns that are indicative of suspicious behaviour before linking them to relevant trade activity for further analysis.

What sets TZEC apart? eflow’s unique Global Lexicon Service. This allows financial institutions to identify signs of market abuse based on global data and behavioural trends, not just their own limited terms. This means that TZEC provides a depth and breadth of insight that is simply unmatched by other communication surveillance software.

How TZEC adds value to your eComms and trade surveillance strategy

Holistic efficient surveillance

Enhanced decision-making

Technology that evolves with you

Future-proofed eComms surveillance

Strengthened governance

Personalised to your needs

We’re offering a free Market Abuse Health Check

Are you confident in your firm’s eComms and trade surveillance strategy to combat market abuse?

Through our Market Abuse Health Check campaign, Jonathan Dixon, eflow’s Head of Surveillance, will evaluate your current processes and offer expert insights to enhance your eComms surveillance solution. Take advantage of this no-obligation opportunity to ensure your compliance framework is as robust as possible.

eComms surveillance technology that evolves with your business

Centralised eComms monitoring

Automatically monitor all forms of structured and unstructured electronic communications for suspicious activity through one integrated platform

Link trading activity to messages

Digitally link suspicious communications to high-risk trade activity for further investigation with added context

Interrogate all data formats

Sophisticated natural language processing algorithms enable you to interrogate unstructured data quickly and efficiently

Monitor all major channels

Ingest data from multiple digital sources, including email providers, Microsoft Teams, Slack, Bloomberg messaging, Red Box call recording, and other platforms

Assess message sentiment

Detect if an individual’s messages are threatening or coercive through the platform’s ‘sentiment analysis’ capabilities

Generate digital audit trails

Automatically generate a digital audit trail as part of your regulatory record-keeping obligations

eflow’s commitment to product development as regulation changes stands out amongst its competitors. With eflow we are confident that we have a partner that will evolve as our requirements also evolve.

Linking trade and eComms surveillance

Integrating trade and eComms - The future of surveillance

Blog

Regulators today are constantly emphasising the importance of having a surveillance system in place that can capture both structured trade data and unstructured comms data. This guide looks at some of the key challenges of achieving this and how to overcome them.

The latest regulatory insights from eflow

Read our experts’ views on the latest developments in regulation, market abuse, trade surveillance, and much more.