TZTS Trade Surveillance software for market abuse

With financial institutions under increasing pressure to demonstrate compliance, robust and holistic trade surveillance software is an essential component of your regulatory strategy. eflow’s TZTS has been engineered to provide firms with a cutting-edge, dynamic solution for tackling market abuse while streamlining compliance processes.

Simplify, streamline and strengthen your trade surveillance

Powered by machine learning and behavioural analytics, TZTS offers unparalleled trade surveillance and market abuse monitoring capabilities. It monitors for FCA/EU (MAR)/SEC/CFTC/MAS and other NCA-designated agencies’ market manipulation and insider dealing typologies. eflow’s trade surveillance software not only identifies suspicious behaviour but also provides supporting evidence to the relevant NCA.

TZTS supports all major asset classes, can be tailored to meet your specific requirements, and enables dynamic parameter adjustments. By automating market abuse monitoring and compliance checks, TZTS allows firms to meet global regulatory obligations more efficiently.

How TZTS adds value to your trade surveillance strategy

With the regulatory landscape evolving rapidly, TZTS has been designed as a flexible market abuse system that adapts to both organisational and market changes.

Customisable implementation options, regular updates and dynamic parameter testing means that TZTS is the most flexible and feature-rich trade surveillance solution available on the market today. However, this depth of functionality doesn’t mean that it needs constant attention to make the most of it. Seamless workflow automation and an intuitive user experience means you spend less time worrying about your compliance procedures, and more time focusing on your business goals.

Automate your trade surveillance

Faster, more robust reporting

Enrich your trade data automatically

Meet regulatory obligations more efficiently

Combine your regulatory and commercial goals

Investigate historic trading activity quicker

Create ‘one source of the truth’

‘Always on’ trade surveillance

Fine-tune your system

Trade surveillance technology that evolves with your business

Comprehensive monitoring

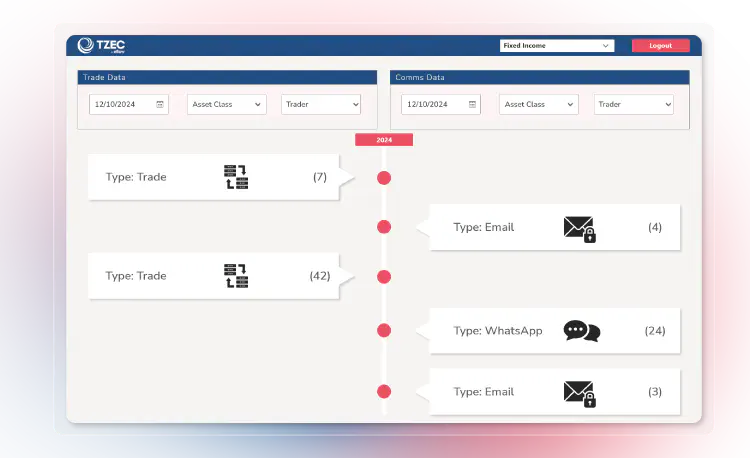

Automatically monitor your trades, identify suspicious behaviour, and generate evidence of market abuse

Data enrichment

Automated data enrichment for all alerts and asset types from the eflow Market Data Store which curates data from more than 250 sources

Trackable platform use

Gain insights on how your compliance team is interacting with the system and view full internal audit trails

Data archiving

MiFID II-compliant data archiving and indexing included as standard

Clear reporting

View all flagged trades, process and report them however you see fit

Order book replay

Explore, replay and report on historical trading activity quickly and clearly

Data-led insights

Group your alert generation history by entity, trader or instrument and compare them to general market trends and movements

Real-time alerts

Receive notifications when edits are made to alerts and access activity logs to maintain audit trails

Tailored reporting

Set test parameters to automatically account for variables and reduce false positives.

As our business grows, it’s imperative that our trade surveillance technology can scale with us. eflow’s TZTS system will help us to automate previously manual processes, strengthen our end-to-end regulatory controls, and operate more efficiently.

The latest regulatory insights from eflow

Read our experts’ views on the latest developments in regulation, market abuse, trade surveillance, and much more.