TZTR Transaction Reporting

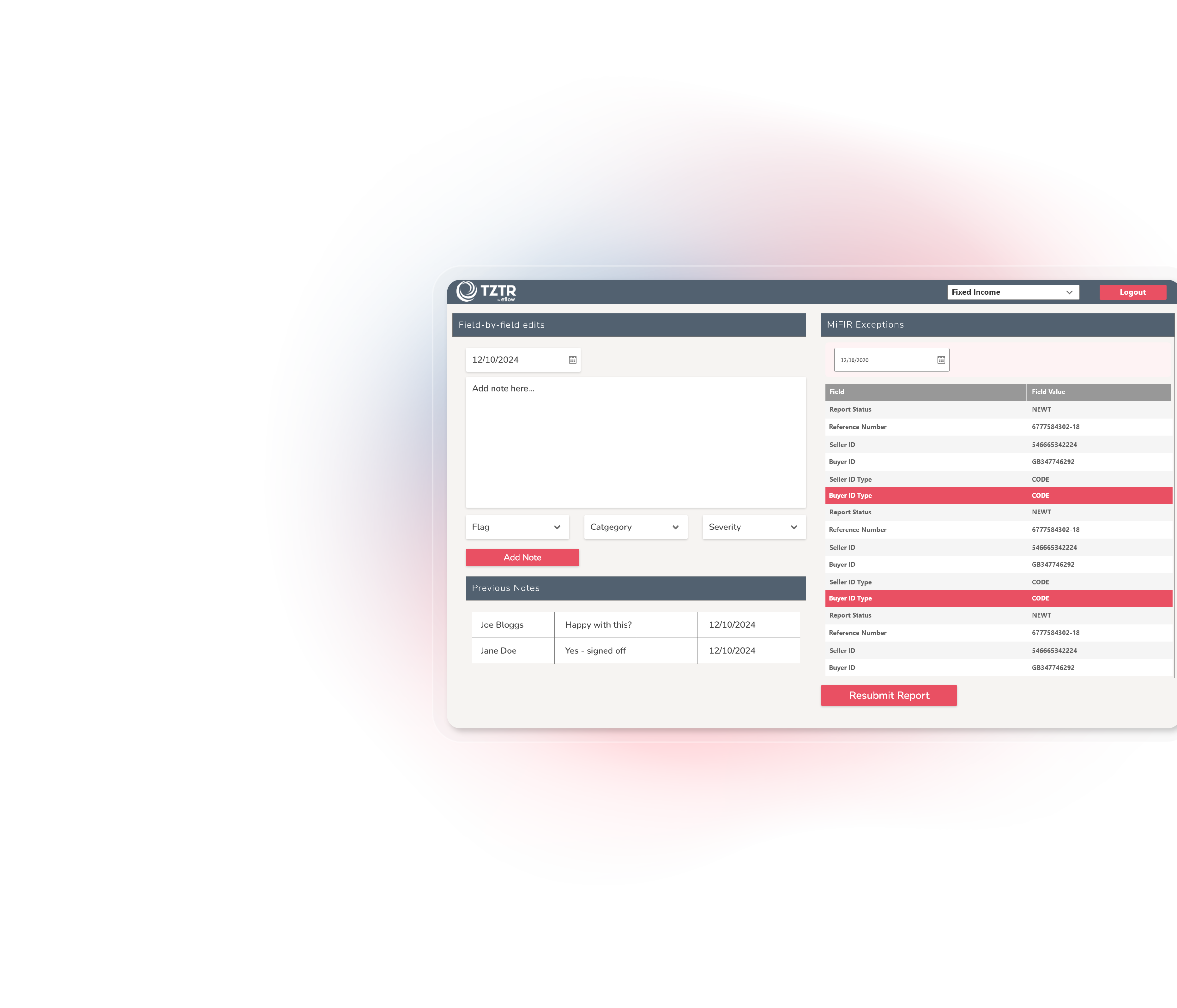

TZTR Transaction Reporting is eflow’s universal platform designed to centralise and automate all your trade and transaction reporting activities. From regulatory reporting compliance under EMIR and MiFIR to robust error handling and submission processes, TZTR delivers a complete, user-friendly solution through a single digital hub.

EMIR Reporting

MiFIR Reporting

Switching made simple

No disruption

The switch to TZTR from other transaction reporting solutions is seamless – there will be no gaps in your transaction reporting procedures. Our support team will guide you through every step of the migration process.

Retrospective data testing

We will happily back test client trade data to ensure retrospective compliance. Our data analysis team will walk you through this process.

Historical data imports

When you sign up for TZTR, we will import your historic transaction reporting files to ensure you have continuity of data and a proper audit trail.

EMIR Transaction Reporting Explained

EMIR Reporting Explained – What You Need to Know

Blog

Confused about your EMIR reporting requirements? This short, simple guide provides an overview of EMIR, giving you and your firm the information you need to stay compliant.