Understanding the Markets in Crypto-Assets regulation

An Overview of MiCA

In a 2008 whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System”, a programmer or group of programmers under the pseudonym Satoshi Nakamoto unveiled the first ever cryptocurrency, Bitcoin. Its creators hoped to address the shortcomings of the traditional financial system which had been criticised for its centralisation, high transaction fees, lengthy settlement times, and lack of transparency. The primary motivation behind Bitcoin’s creation was to establish a decentralised digital currency that operates without the need for intermediaries such as banks or governments. Cryptocurrencies remained largely misunderstood throughout the early 2010’s, pushed by a relatively small group of advocates with an almost cult-like persistence.

Digital assets and cryptocurrencies truly infiltrated public consciousness in 2017 during their meteoric rise in market capitalisation and trading volumes, followed by an equally thrilling - and for many, painful - fall from grace. While we’ve heard a few success stories from the 2017 crypto rally, it left countless victims in its wake. Following Crypto’s 2017 rise and fall, Executive Vice-President Dombrovskis, in a letter addressed to the European Banking Authority (EBA) and the European Securities and Markets Authority (ESMA), urged them to reiterate their warnings to investors. This FinTech Action Plan mandated that the EBA and ESMA assess the applicability and suitability of the existing regulatory framework to crypto-assets.

Ultimately, this assessment found that while some crypto-assets could fall within the scope of EU legislation, effectively applying this to these assets was far from straightforward. At the same time, the EBA and ESMA underlined that – beyond EU legislation aimed at combating money laundering and terrorism financing – most crypto-assets fall outside the scope of EU financial services legislation and therefore are not subject to provisions on consumer and investor protection and market integrity, among others, although they give rise to these risks.[1]

MiCA (Markets in Crypto-assets) was proposed by the European Commission on September 24, 2020 with the primary objective of establishing a comprehensive and harmonised regulatory framework for crypto-assets, including cryptocurrencies, utility tokens, and stablecoins, within the EU. The proposal came with four general and related objectives:

- Legal certainty - develop a sound legal framework, clearly defining the regulatory treatment of all crypto-assets that are not covered by existing financial services legislation.

- Support innovation - promote the development of crypto-assets and the wider use of Distributed Ledger Technology (DLT) via a safe and proportionate framework to support innovation and fair competition.

- Investor protection - crypto poses many of the same risks as more familiar financial instruments, these must be addressed with the same rigour as with traditional financial markets.

- Financial stability - Crypto-assets are continuously evolving. While some have a quite limited scope and use, others, such as the emerging category of ‘stablecoins’, have the potential to become widely accepted and potentially systemic.

What does MiCA mean for firms trading crypto assets?

MiCA aims to safeguard investors through enhanced transparency and the establishment of a comprehensive framework for issuers of digital assets and service providers including trading venues. This framework includes adherence to anti-money laundering and market abuse regulations, aligning the crypto industry to the EU’s broader regulatory frameworks including the EU Market Abuse Regulation (MAR) and MiFID II.

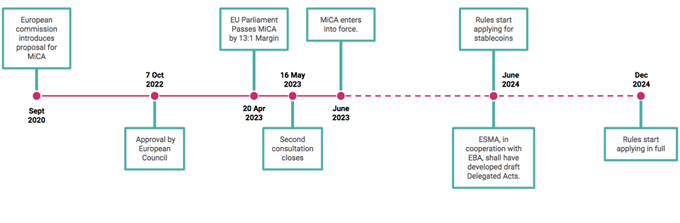

Figure 1 - Timeline for MiCA implementation

AML & KYC

MiCA requires that firms engaged in crypto asset activities establish robust anti-money laundering (AML) and know your customer (KYC) processes. These processes, which were previously considered nice to have, are now mandatory for operating within the EU. CASPs will be obligated to conduct due diligence on all clients, including verifying their identities, ensuring they are not sanctioned individuals, and storing personal and Money Laundering/Terrorist Financing prevention data.

The need for robust customer due diligence is made greater by the introduction of the revised Transfer of Funds Regulation in parallel with MiCA. TFR aims to implement the Financial Action Task Force’s (FATF’s) Recommendation 16 (Travel Rule) to virtual asset transfers involving European CASPs. In these cases, information on the source and beneficiary of the asset must “travel” with the transaction. This information includes data pertaining to the client’s identity (name, address, date of birth, place of birth, etc.) as well as proof that the customer is not a sanctioned individual.

Market Abuse

MiCA, the Markets in Crypto-assets Regulation, introduces a set of rules specifically addressing market abuse in the crypto asset industry. The market abuse rules under MiCA apply to all individuals engaged in actions related to crypto-assets admitted to trading platforms authorised under MiCA or crypto-assets that have sought admission to trading. These rules closely resemble the established framework of the Market Abuse Regulation (MAR) in traditional finance, providing a familiar grounding for trading firms:

Disclosure of Inside Information and Insider Dealing

MiCA mandates that crypto asset issuers publicly disclose inside information related to their company and tokens in a timely and widespread manner. Inside information refers to data that can significantly impact the value of crypto assets. While issuers may delay the disclosure in certain circumstances to protect their legitimate interests, such delays should not mislead the public and confidentiality must be ensured.

In other cases, where normal procedures and channels are not used, the disclosure of inside information is not authorised. And MiCA otherwise strictly prohibits insider dealing, which involves using undisclosed inside information for personal trading or recommending investment actions to others.

Market Manipulation

The unique characteristics of distributed ledger technology, coupled with the volatility of prices and high ownership concentration in the crypto asset markets, make these instruments particularly susceptible to manipulative practices. MiCA addresses these practices, such as distorting demand and supply signals or disseminating false or misleading information about crypto assets. This includes activities like “pump and dump” schemes and unfair trading techniques.

Impacts on firms

Trading firms involved in crypto asset activities will need to adapt their practices and implement measures to comply with MiCA’s market abuse rules, as non-compliance can lead to significant sanctions. These include orders for restitution, suspension or withdrawal of crypto asset service providers’ (CASPs’) authorisations, bans on responsible individuals, and substantial administrative sanctions.

Systems and Controls

Firms will need to establish robust systems and controls to detect and prevent market abuse. Given the evolving nature of the crypto market and the innovative techniques employed by bad actors, these systems may need to be sophisticated and adaptable. They should be capable of monitoring and analysing a wide range of market data to identify any suspicious activities or patterns that may indicate market manipulation or insider trading.

Suspicious Transactions Reporting

MiCA also imposes reporting obligations on CASPs. They are required to report any suspicious transactions or orders to the relevant authorities. This reporting requirement aims to enhance market surveillance and facilitate early detection of potential market abuse.

Record keeping

In addition to reporting, MiCA emphasises the importance of comprehensive record-keeping. Firms must maintain accurate and complete records of all orders, transactions, and communications related to their crypto asset activities. This includes records of client interactions, trade details, and relevant market data. Firms should implement secure and accessible systems for organising and retrieving these records, ensuring they are readily available upon request.

The future of crypto regulation

MiCA introduces a harmonised digital asset regulatory framework to the European Union, representing a huge step forward compared to the current fragmented regulatory landscape across member states. In terms of what this means for the future, as well as the rest of the world, that’s difficult to say, but a clear appetite from regulators across the globe to stifle market abuse is clear to see, and in a broader sense, crypto regulation supports regulators mission to crackdown on market abuse - highlighted by the FCA’s recent Market Watch 73 and past enforcement trends illustrating an increasing regulatory focus on market abuse globally.

With that in mind, it is likely that other jurisdictions will follow the EU’s lead and attempt to establish more uniform rules for the digital asset industry. It is therefore essential for any firm offering digital asset services to future proof their operations in preparation for more stringent regulatory oversight. Practically speaking, this involves employing the right blend of people, processes and technology to ensure proactive risk mitigation in the face of regulatory headwinds.