What Is Trade Surveillance? Market Abuse Monitoring Explained

Does your firm need a trade surveillance solution? Get in touch to find out how we can help.

What Exactly is Trade Surveillance?

While it can get very complex in practice, the concept is fairly simple: trade surveillance is the process of monitoring financial transactions for potentially illegal or abusive trading. This is a requirement of most financial regulators throughout the world.

What is a Trade Surveillance System?

More often than not the act of trade surveillance is carried out by an automated ‘trade surveillance system’. A trade surveillance system is a web app or piece of software designed to capture a firm’s trade data and automatically test that data to find and flag any instances of potential market abuse.

While manually reviewing trade data might technically be considered trade surveillance, the stringent regulations put in place by financial regulators essentially invalidates this approach to market abuse monitoring. In their Market Watch 69 newsletter, the FCA stated that it was no longer sufficient to ‘apply generic calibration across (and within) asset classes, where the nature and scale of the metrics involved are significantly different’, highlighting the need for a more sophisticated approach to market abuse detection.

The complexity of current financial regulations, the number of different forms of potential market abuse which exist, and the sheer quantity of data which must be monitored in order to comply with the relevant regulations necessitates at least some level of automation in order for a trade surveillance system to be accepted by financial regulators.

Do I Need a Trade Surveillance System?

Chances are, if you are part of a financial firm that takes part in the trading of financial instruments, you will need to implement a trade surveillance system. Monitoring, capturing and reporting abusive trading is required by all global financial regulators, and while the actual regulations put in place by these regulators vary from country to country, the need for appropriate trade surveillance processes is essentially universal.

In the past, before the RegTech industry was well-established and specialised compliance vendors began to offer products to the market, in-house trade surveillance solutions were far more common. However, as the demands of regulators grow stricter and the regulatory requirements of firms become more varied and complex, these legacy systems are becoming less and less common. Regulators are no longer only concerned with the regulation of vanilla equity markets, but are rather taking a more high-level “helicopter” approach in an attempt to expand their visibility across more exotic asset classes - an approach which further invalidates legacy surveillance systems.

Since the late 2010s, many firms have begun opting for best-in-class market abuse vendors or holistic, all-in-one compliance solutions rather than attempting to shoulder their own regulatory burdens by building and maintaining in-house solutions.

Legacy systems are often hard coded, making them difficult to adapt and expensive to update. With the rapid rate of current regulatory change, this approach is becoming more and more unviable.

What Happens if I Don’t Have a Trade Surveillance System?

Firms who trade without a trade surveillance system risk fines, permanent closure or even prison time.

Before acts like MAR, MiFID II and Dodd-Frank were passed, financial regulators took a more tokenistic approach to enforcing market integrity. Having something - anything - in place was often regarded as enough to tick a box, and severe punishments and sanctions were rarely, if ever, enforced.

This, however, is no longer the case. Global financial regulators are becoming more stringent by the year. Sanctions are becoming heftier, and the actual requirements firms are expected to meet are becoming stricter and more specific. In recent months, the FCA has stressed the importance of being able to dynamically set testing parameters to account for market variables, the MFSA has imposed stricter market abuse guidelines, and countless financial institutions including E-TRADE and NatWest have been fined by financial regulators for market abuse infringements.

In order to remain compliant, firms today are expected to have a fully automated system capable of performing sophisticated, machine-learning powered tests on anything from a few dozen to millions of trades per day; anything less than this risks swift regulatory action.

How Does Trade Surveillance Work?

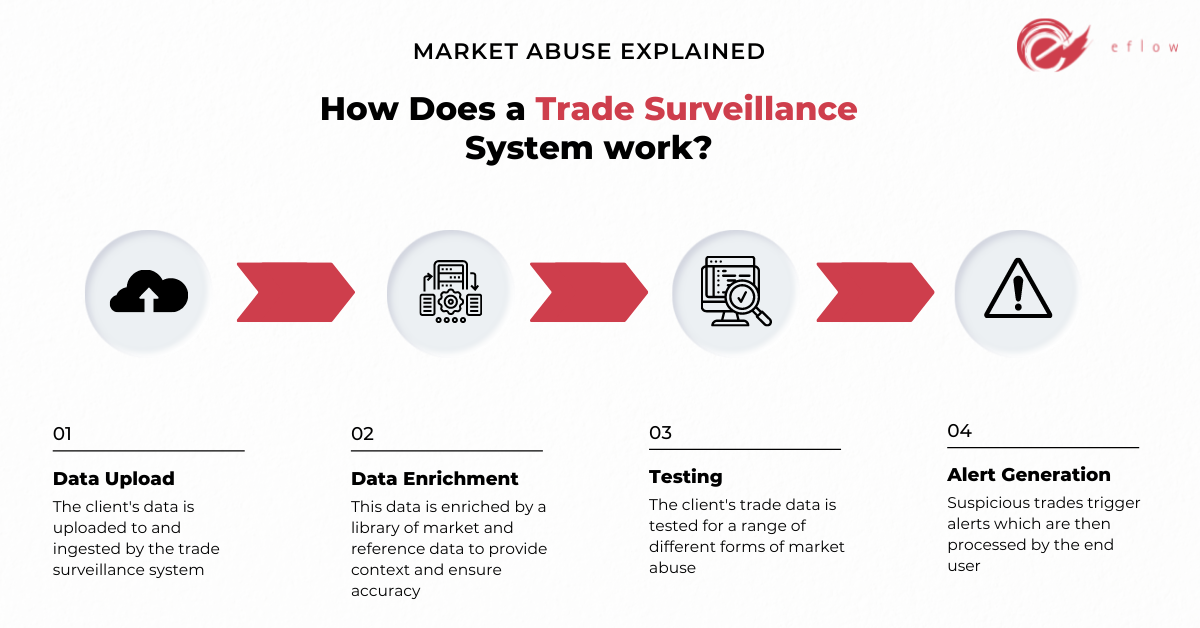

Exactly how a trade surveillance system works will obviously vary depending on the system being used. Even so, assuming we’re talking about an automated system that meets the demands of financial regulators as they stand today, there are certain features which all good trade surveillance systems should have.

The process will usually start with the trade surveillance system automatically loading all of a client’s trade data. This data will then usually be enriched with market data and reference data. This step allows the surveillance system to analyse a client’s trade data against the market so that any anomalies can be highlighted.

The system will then perform a number of tests on the client’s trade data and flag any instances of trading which are considered suspicious.

It will then generally be the job of a firm’s compliance team to manually review any flagged trades. False positives can then be closed off and disregarded, while genuinely suspicious trades can be captured and added to reports which can then be sent to regulators.

Because of how data-dense this process can be, a good trade surveillance system should attempt to simplify and minimise the amount of information displayed to the user. Features such as being exception-based (only displaying infringing or potentially suspicious trade data), escalation workflows, note making and full audit trails all contribute to this and should be seen as high priority when shopping for a trade surveillance solution.

What Types of Trading Can Be Captured by a Trade Surveillance System?

There are countless different types of illegal trading which fall broadly under the umbrella term of ‘market abuse’. While there is some variation from regulator to regulator, there is general consensus on what constitutes market abuse.

Some of the most common forms of market abuse include:

- Insider dealing / insider trading

- Unlawful disclosure of insider information

- Spoofing

- Marking the Open / Marking the Close

- Wash Trading

- Front Running

- Spoofing

- Pinging

- Quote Stuffing

- Layering

- Cross-Venue Manipulation

- Ramping

- Churning

- Painting the Tape

- Pump and Dump

What Regulations Enforce Market Abuse Monitoring?

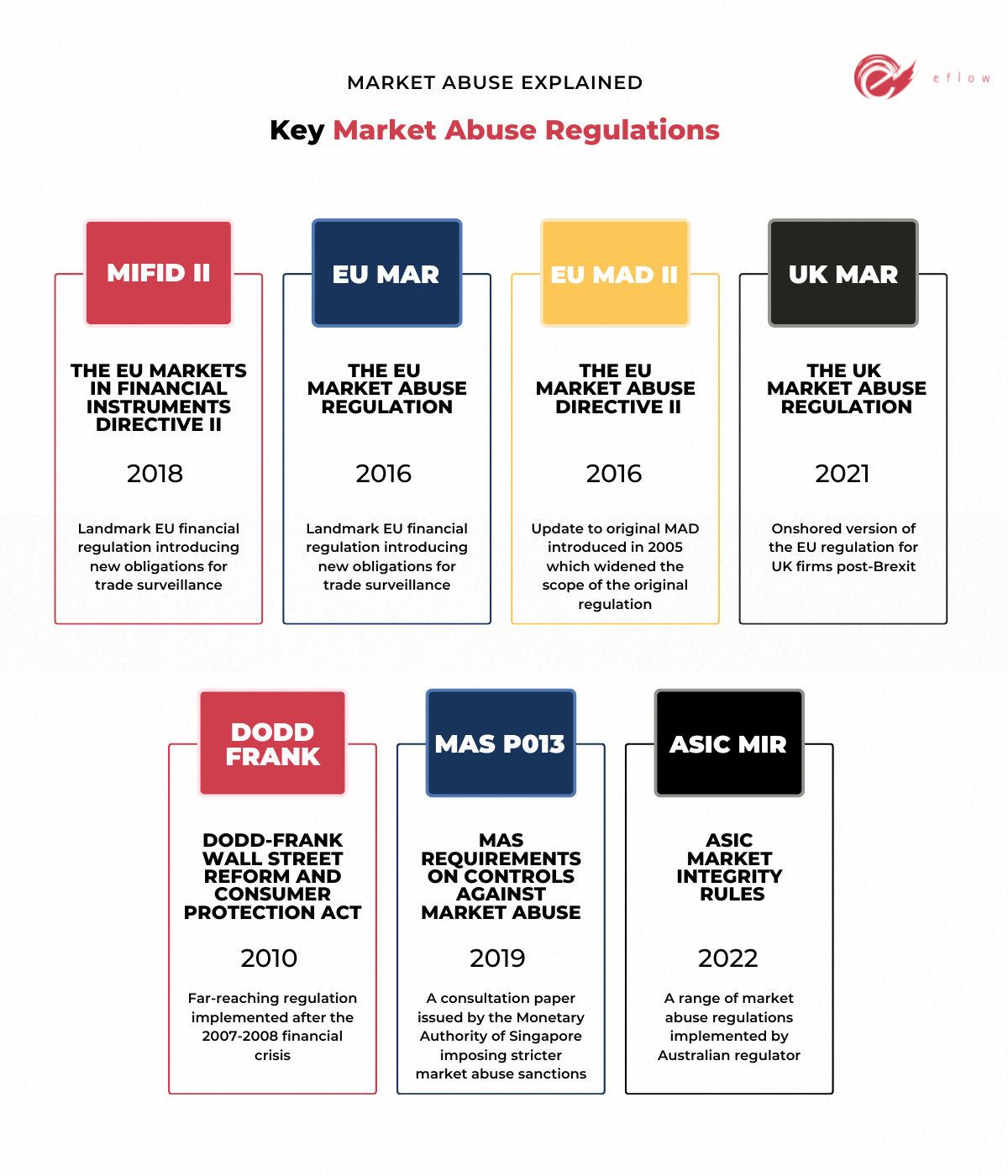

Essentially all global financial regulators enforce market abuse regulations which require firms to perform trade surveillance in order to stay compliant. While some regulators are more advanced than others, the vast majority of regulators enforce some form of market abuse regulation. Some of the more prominent of these regulations include:

The EU Markets in Financial Instruments Directive II (MiFID II)

Introduced in January of 2018, MiFID II entirely transformed the European approach to financial regulation, not just with regards to market abuse, but the integrity of European financial markets as a whole.

Amongst a huge range of other regulations, MiFID II greatly strengthened trade surveillance requirements for UK firms. Under MiFID II, firms are required to capture and store both trade and communication data relating to a transaction for 5-7 years, regardless of whether or not that transaction was actually executed. It also provided regulators with the power to demand that authorised firms reconstruct a transaction if abusive trading is suspected.

The EU Market Abuse Regulation (596/2014/EU) (EU MAR)

MAR came into effect on 3 July 2016 and aimed to ‘establish a more uniform and stronger framework in order to preserve market integrity.’ Under this regulation, ‘any person professionally arranging or executing transactions shall establish and maintain effective arrangements, systems and procedures to detect and report suspicious orders and transactions.’

MAR states that financial firms operating in the EU are expected to publicly disclose inside information, maintain insider lists, and file Suspicious Transaction and Order Reports (STORs) highlighting and potentially suspicious trading ‘without delay’.

EU MAR superseded the pre-existing Market Abuse Directive (2003/6/EC) (MAD), extending its scope to apply to financial instruments traded on Multilateral Trading Facilities (MTFs) and Organised Trading Facilities (OTFs), as well as ‘any other conduct or action which can have an effect on such a financial instrument irrespective of whether it takes place on a trading venue’.

EU MAR also grants national regulators the power to detect and penalise market abuse performed by financial firms in their jurisdiction.

The EU Market Abuse Directive II (EU MAD II)

MAD II can be seen as a ‘legislative package’ combining the regulations set forward in MAR, and the Directive on Criminal Sanctions for Market Abuse (CSMAD). MAD II is a combination of both the regulations with which financial regulations are expected to comply, and the sanctions which EU regulators are entitled to enforce when breaches in these regulations are detected.

The UK Market Abuse Regulation (UK MAR)

Following the United Kingdom’s exit from the European Union, the Financial Conduct Authority (FCA) onshored EU MAR into UK law by the EU (Withdrawal) Act 2018. For the most part, UK MAR is identical to its European originator. Firms are still expected to disclose inside information, maintain insider lists, and submit STORs where necessary.

However, there were minor changes made to STOR reporting under UK MAR. Namely, entities trading in the UK, or with branches in the UK, must report STORs to the FCA, regardless of their obligations under EU law to report STORs to an EU authority. This can lead to instances of double reporting for multinational firms with bases of operation in both the UK and the EU.

Dodd-Frank Wall Street Reform and Consumer Protection Act (US Dodd-Frank)

Implemented in the wake of the 2007-2008 financial crisis, the Dodd-Frank Act established a number of agencies to enforce stricter regulation of the financial services industry while implementing a number of new market abuse regulations. Among other things, Dodd-Frank implemented regulations which required firms to publicly disclose more information with regards to swaps trading in an attempt to improve both transparency and integrity. Some of the restrictions enforced by Dodd-Frank were repealed in 2018 by the US congress.

MAS Requirements on Controls against Market Abuse (P013-2019)

While not technically a regulation, this consultation paper outlines the Monetary Authority of Singapore’s proposal to impose stricter market abuse regulations for financial institutions operating in Singapore. Like the European regulations listed above, this paper proposed the public disclosure of the ‘ultimate beneficial owners of orders and trades’ as well as record keeping for transactions and instructions for broker-assisted orders and trades.

ASIC Market Integrity Rules

The Australian Securities and Investments Commision have implemented a range of market abuse regulations for firms with direct market access. Firms with DMA operating in Australia must notify ASIC of suspected misconduct by was of Suspicious Activity Reports (SARs)

I’m Concerned About My Firm’s Compliance - What Should I Do?

If you’ve found the above information confusing, you aren’t alone. Regulatory compliance is a hugely complex topic, and understanding your firm’s specific requirements can feel like an impossible task.

Your first approach should always be to speak with a compliance expert to better understand your requirements - once you understand your requirements, it will make choosing the right trade surveillance system much easier.

We offer free consultations at this link if you would like to discuss your market abuse monitoring and trade surveillance requirements in more detail.